備案號(hào):遼ICP備19007957號(hào)-1

![]() 聆聽您的聲音:feedback@highmark.com.cn企業(yè)熱線:400-778-8318

聆聽您的聲音:feedback@highmark.com.cn企業(yè)熱線:400-778-8318

Copyright ?2015- 海馬課堂網(wǎng)絡(luò)科技(大連)有限公司辦公地址:遼寧省大連市高新技術(shù)產(chǎn)業(yè)園區(qū)火炬路32A號(hào)創(chuàng)業(yè)大廈A座18層1801室

Since shadow banking is very popular in the modern world, it is worth to study the current development of shadow banking system throughout the world and evaluate the influences on financial system and stakeholders caused by the development of shadow banking. In the next sections, we will firstly define the term of shadow banking, review the current development of this new financial entities, and explain the attractions of shadow banking. Then the evaluation of the positive and negative effects of financial system and stakeholders will be conducted. In the end, the main points will be concluded and recommendations will be given for the further development of shadow banking.

There are many definitions of shadow banking and it is hard to decide which one is the best. In 2012, Financial Stability Board (FSB) described the shadow banking as “credit intermediation involving entities and activities (fully or partially) outside the regular banking system’’. And shadow banking can also be defined as non-banks which perform banking activities that are not regulated (Schmidt 2003). Both definitions have been applied in many papers and articles. However, these descriptions are more like a benchmark to justify the behavior of shadow banks rather than clear and precise definitions.

Claessenss & Lev Ratnovski (2014) defined shadow banking as “all financial activities, except traditional banking, which requires a private or public backstop to operate.’ This definition describes the characteristics of shadow banking activities today and the characteristics of future shadow banking activities.

Shadow banking can be best defined by exploring its development. There are two flaws about the definitions above. The first one is that there are some activities that are not supposed to be included into shadow banking, such as leasing and financing companies or corporate tax vehicles. Indeed shadow banking which originally encompassed leasing and financing including investment banking. These activities were provided by non-banks to support financing activities which were outside traditional banking. These activities are now embraced by banks as extension of the commercial banking activities.

Secondly, the location of shadow banking is described outside banks according to this definition. In reality, many shadow banking activities are conducted within banks. Many OFB (Off-Balance Sheet)) instruments are non-traditional banking activities. These activities consist of collateral operations of dealer banks, activities associated with repos, and so on. According to Cetorelli and Peristiani in 2012, this definition is less useful from operational point of view.

Another definition of shadow banking is considered from the functional point of view. This definition describes shadow banking as a collection of some particular intermediation services. In addition, each service was designed as a response for a demand. For instance, the demand for safe assets causes the occurrence of securitization, while collateral service is a response to the need of making full use of the scarce collateral which can support the secured transactions. The most important advantage is that this definition offers the insight views of the analysis of financial services. It reveals that the shadow banking is not only caused by the regulatory arbitrage, but also triggered by the general demand. Pozsar et al., in 2012 argued that based on this definition, if the government tends to regulate shadow banking effectively, the demands for these services and how these services are provided should be understood.

Given the existence of banks, there are still some attractions of shadow banking existence.

Firstly, the shadow banking as an intermediation is more efficient than traditional banks, and can offer healthy completion for existed banks. For example, the traditional banks are restricted in some sectors, thus there are some gaps in the financial markets. Then the shadow banking evolves and fulfills the gaps. As a result, the market becomes more efficient. Moreover, it is beneficial to the stability of banking system. The risks can be transferred from banking system to outside, and the investors are willing to hold these risks through market mechanisms. In fact, even though traditional banks and shadow banks have separate functions, they are interdependent. Shadow banking depends on the liquidity lines of traditional banks, while the traditional banks rely on shadow banks to fund through some special activities, which are not allowed in traditional banks (Lane, 2013).

The article of “Non-bank lending steps out of the shadows” in the Financial Times summed up the sentiments in the US of how shadow banks – business development companies – investment vehicle that support small companies with credit. (Financial Times, Dec 14, 2014)

The current financial environment is beneficial to further growth of shadow banking. There is an increasing of shadow banking activities in the United States, and Europe recently. Some activities are declining such as securitization, while some less risky activities display an increasing trending such as investment funds.

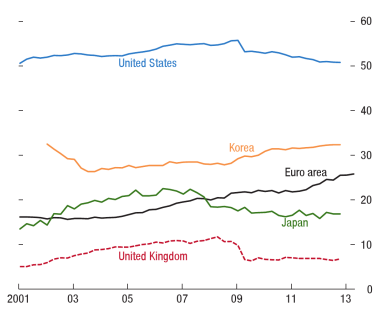

As banks retreat in the wake of the financial crisis, non-traditional banks are taking on a growing share of the business and supports growth. In the United States, the risks caused by the shadow banking activities kept rising, but at a pre-crisis level. Also, there is significant cross-border effects of shadow banking in developed countries by research evidence. By comparison, in emerging markets, the growth rate of shadow banking in China is particularly high. In Figure 1, we can see that percent of bank and shadow bank lending from 2001 to 2013 around the world (IMF, 2014). In the emerging markets, the increasing rate of shadow banking is higher than that of traditional banking. The reason of this growth in developing market is associated with rise in pension, sovereign wealth, and insurance funds (Lane, 2013).

Figure 1 Lending by shadow banks

(Source: national central banks and IMF staff estimates, 2014)

The definition of financial system is not very clear, like the definition of shadow banking. We consider it in narrow concept and broad concept two ways. Firstly, in narrow context, this term refers to the financial sector. It is a sector in the whole economy, which provides financial services to the other sectors. The important parts of this sector include central bank, commercial banks and other banks, financial institutions excluding banks, organized financial markets, and the regulation suthorities which supervise the financial activities. Secondly, we consider this term in broad context. This concept of financial system is defined as the interaction between the supply and the demand of capital. The banks act as the financial intermediations between the savers and the business. Instead of depositing money in banks, the savers can invest in the capital market in order to make profit bearing risks. At the same time, the business units also engage in the investment activities in the capital market. All the financial activities in the financial system are supervised by government and relevant institutions. The shadow banks we discuss in this paper outside the banks as another kind of financial intermediations between the savers and business units (Schmidt, 2003).

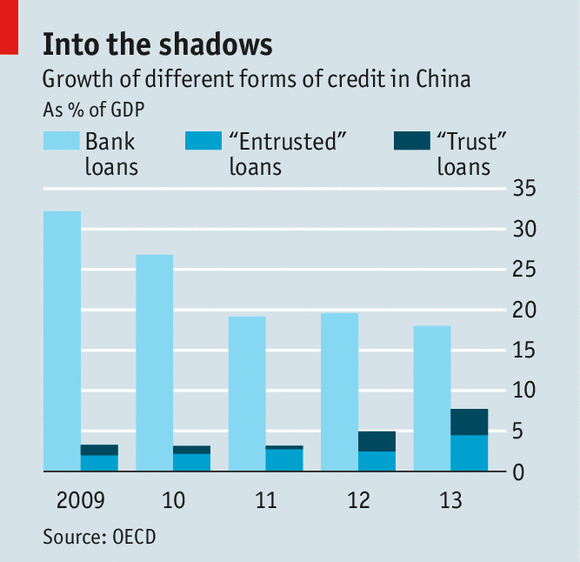

In China, shadow banks accounted for almost a third of the rise in lending last year, swelling by over 50% in the process in Figure 2. By offering returns, they raise money from businesses and individuals frustrated by the low cap the government imposes for interest rates on bank deposits. They lend to firms that are unable to borrow from banks with the curbs from the government.

Figure 2 Growth of different forms of credit in China

(Source: Financial Times (May 10th2014) “Shadow Banking in China”)

The main function of shadow banking is to transform the risk environment of simple process in the traditional banking into a more complicated financial activities environment. This can be attributed to the increasingly complex financial systems and the rising demand of various stakeholders. The original process of traditional banking is to deposit the money until maturity, and to lend money to make profits from the interest spread, which has a low return on equity. The financial activities of the shadow banks involve a more complicated, wholesale-funded, hold-to-sales, securitization-based, fee-driven lending. They have high return on equity (European Repo Council, 2012).

One positive impact of shadow banking on financial system is to stabilize the financial system as a whole. In terms of traditional banks, the borrowers and lenders can skip the intermediation and trade directly, which will results in losses of banks.

We call it the disintermediation of traditional banks. This in return will damage the efficiency of traditional banks and increase the costs of them. The securitization requires real credit risk transfer, which helps the issuer to diversify the loans, borrowers, and markets. The lenders can benefit from economies of scale of the structure of loans. In addition, the securitization is beneficial to the supervision of traditional banks by means of offering third party discipline and market pricing of assets (Pozsar et al., 2010).

With the existence of shadow banking, the financial system becomes more decentralized, which can help the system remain robust in the light of financial shocks. The reason is that the existence of shadow banks reduces the general sizes of most intermediations, and then prevents the business from concentration that makes the institutions into systemically important entities. The systemic risks of transmission can be alleviated by the diversification of functions.

The shadow banking can allocate the resources to the specific demands, which makes the funds allocation of financial system more efficient. The reason why shadow banks can do it is due to the increased specialization.

Thus, it is obvious that the existence of shadow banking enhances the efficiency of financial market and hence benefits both lenders and borrowers. It should be noticed for regulatory institutions that all the regulations are better to have particular target problems in case the damage of the functions of shadow banking would appear (Pozsar et al., 2010).

It is known that the traditional banking system is linked with the shadow banking system. Different from the positive side of shadow banking, some researchers argue that the interconnectedness of the shadow banking and traditional banking can increase contagion and systemic risks. Then, counter-party risks increased. As a result, the financial stability will be damaged by them. What is worse, the global financial crisis may occur (Jeffers & Baicu, 2013).

For instance, it is believed that one of the causes for the global financial crisis in 2008 is the rise of the shadow banking system. Fannie Mae and Freddie Mac, traditional housing mortgage institutions protected by the government, participated in financial instruments that belong to the shadow banking system, which have not been regulated in the traditional way. As a consequence, these two institutions bought large amount of mortgage loans, which provided liquidity to the secondary mortgages market and indirectly caused the sub-prime crisis. (Jeffers & Baicu, 2013).

Stakeholders of shadow banking are quite similar to the stakeholders of the financial system. The main groups of stakeholders in the shadow banking system include the governments, regulatory institution, traditional banks, large corporations and SMEs, financial institutions and ordinary investors.

The government agencies have responsibilities to make sure that the financial markets operate transparently and continuously. However, due the complexity of shadow banking system, the government and the regulatory institutions can hardly monitor the full operation of the system. The lack of transparency many lead to ineffective monetary policies and economic policies.

One positive impact of shadow banking on the stakeholders is that it provides more opportunities for market participants. For instance, the shadow banking can offer large corporations and SMEs with an alternative source of funding and liquidity (Baldoni & Chockler, 2011). Especially, when the corporations cannot satisfy the requirements of traditional banks, the shadow banks can finance the corporations with high liquidity. In term of the government agencies, it also provides alternative source of funds. For example, when there is a serious deficit in the government, the government agencies can finance themselves through shadow banking services instead of increasing taxes.

The existence of shadow banking offers liquidity for stakeholders and then reduce the relevant transactions cost associated with traditional banks. The high profitability and liquidity are the most important attractiveness for institutional stakeholders (Baldoni & Chockler, 2011).

However, based on above analysis, we can see that the shadow banking can accelerate and amplify the expansion of financial crisis. As a result, most of the financial institutional stakeholders will suffer from this financial crisis (European Repo Council, 2012).

Compared with traditional banking activities, the investments in the shadow banking sector is more attractive due to the high expected return. But the associated risks are also high accordingly. The existence of shadow banking can attract the financial institutions to take high-profit projects with high risks, which increases the default risks. In addition, since the financial institutional stakeholders can benefit from the shadow banking which is regulated less than traditional banks, the potential risks of regulatory agencies rise (European Repo Council, 2012). The existence of shadow banking increases the difficulty level of regulating the financial markets for regulatory agencies. In recent years, shadow banking in China remains a hot issue. The GDP growth of China is partially supported by the expansion of the scale of shadow banking in China Parker, 2012). It is reasonable to infer that if the Chinese governments take aggressive measures on regulating the shadow banking, the GDP growth of China may decline even further. For example, the lower GDP growth of 7% in China is attributive to the stricter regulation of shadow banking.

In conclusion, the shadow banking system is vital to the financial system and the global economy as a whole, with the retreat of traditional banks in the wake of the financial crisis (The Economist, May 10, 2014), thus it is worth studying. First of all, we discuss the various definitions of shadow banking. The functional approach gives us insight of this system, but it has difficulty in listing all activities.

Since the shadow banking can create a healthy competition environment and enhance the stability of financial system, the growth rate of shadow banking all over the world is very high. There are several advantages of shadow banking.

Firstly, it can stabilize the financial system. It provides alternative financing for those of need credit. Secondly, it can reduce the transaction cost and provide liquidity to stakeholders. However, there are many risks arising with the shadow banking, too.

In order to cope with the risks of shadow banking, regulators including the recommendations of Basel III bring up some recommendations rules and control over shadow banking activities. This could be healthy for the further development of shadow banking system.

First of all, there should be some more regulations and rules on the operation of shadow banking. These regulations are supposed to be designed with limitations. The limitation is that they cannot reduce the efficiency of shadow banking due to the gaps in the regulation area. For example, the interconnections between banks can be controlled to reduce potential risks.

For regulators, there are two issues to be concerned. Firstly, the maturity transformation is extremely serious when all savers withdraw their funds simultaneously. The second item is about the volume of credit extended. When the lent credit increases, the prices of assets rise, which indicates lower losses on credit extended. Thus, banks can lend more funds until the confidence crisis cause all the factors to move in the opposite directions (Claessens et al., 2012).

For the investors who participate in the market with shadow banks involve, it is suggested that they should pay more attention to the analysis of the investment projects, and consider the relevant risks associated with high expected returns. In particular, the idea of “too big to fail” must be watched out when investors assess the large financial institutions.

References

Baaldoni, R., and Chockler, G. (2011). ‘Collaborative Financial Infrastructure Protection: Tools, Abstractions, and Moddeleware.’ Springer.

Clasessens, S., and Ratnovsko, L. (2014). ‘What is shadow banking?’IMF Working Paper, 14/25.

Claessens, S., Pozsar, Z., Ratnovski, L., and Singh, M. (2012). ‘Shadow Banking: Economicsand Policy,’ IMF Staff Discussion Note 12/12 (Washington, D.C.).

Cetorelli, N., and Peristiani, S. (2012). ‘The Role of Banks in Asset Securitization’, Federal Reserve Bank of New York Economic Policy Review, 18, 2, 47-64.

European Repo Council.(2012). ‘Shadow banking and repo’, March, 2012.

Financial Stability Board.(2012). ‘Strengthening Oversight and Regulation of Shadow Banking’, Consultative Document.

International Monetary Fund.(2014). ‘Global Financial Stability Report-----Risk Taking Liquidity, and Shadow Banking’. Washington.

Jeffers, E., and Baicu, C. (2013).‘The Interconnections between the Shadow Banking System and the Regular Banking System. Evidence from the Euro Area’, City Political Economy Research Centre.

Lane, T. (2013).‘Shedding light on shadow banking’, CFA Society Toronto, 26 June 2013.

Schmidt, H. R. (2003). ‘What constitutes a financial system in general and the German financial system in particular?’ Working paper series: Finance and Accounting.

Financial Times (May 10th2014) “Shadow Banking in China”.

Pozsar, Z., Adrian, T., Ashcraft, A., and Boesky, H. (2012).‘Shadow Banking’, New York Fed Staff Report 458.

Parker, J. (2012). ‘Shadow Banking’ in China. [online] The Diplomat. Available at: http://thediplomat.com/2012/10/the-rise-of-shadow-banking-in-china/ [Accessed 17 Oct. 2012].

24h在線客服

24h在線客服

備案號(hào):遼ICP備19007957號(hào)-1

![]() 聆聽您的聲音:feedback@highmark.com.cn企業(yè)熱線:400-778-8318

聆聽您的聲音:feedback@highmark.com.cn企業(yè)熱線:400-778-8318

Copyright ?2015- 海馬課堂網(wǎng)絡(luò)科技(大連)有限公司辦公地址:遼寧省大連市高新技術(shù)產(chǎn)業(yè)園區(qū)火炬路32A號(hào)創(chuàng)業(yè)大廈A座18層1801室

499元

一節(jié)課

咨詢電話

咨詢電話:

186-0428-2029

在線咨詢

微信客服

微信咨詢

回到頂部

hmkt088

97精品久久久| 99久久精品久久亚洲精品| 精品欧美日韩| 91精品无码| 嫩草AV久久伊人妇女超级A| 狠狠爱av| 蜜臀久久精品久久久久| 97视频在线观看免费| 久久久6| 亚洲欧美日韩专区| 久久囯产精品99蜜桃传媒| 久久久av电影| 九九综合网| 亚洲AV无码一区二区乱| 久久精品一本| 欧美日韩激情视频| 欧美h视频| 久久久久国产一区| 欧美熟妇交换久久久久久分类| 无码在线人妻| 五月丁香激情网站| 日本一道本视频| 91av在线免费| 最近日本中文字幕| 夜夜操天天爽| 超碰97人人妻| 性做爰1一7伦| 毛片毛片毛片毛片毛片| 日韩av黄色片| 黑人av在线| 欧美精品成人一区二区在线观看| 久久精品亚洲天堂| 精品成人av一区二区三区| 无码中文字幕电影| 精品日韩人妻| 99精品视频在线观看| 中文人妻无码| 中文字幕网伦射乱中文| 久久人妻少妇| 亚洲a电影| 欧美成人一区三区无码乱码A片| 国产AV熟妇人震精品一品二区| 国产精品白丝Jk白祙| 国产精品亚洲综合| 日韩黄片观一区二区三区| 欧美激情精品| 亚洲色一区| 国产毛片无码| 精品伦一区二区三区| 无码黄色网址| 无码高清不卡| 久久天天干| 国产91色| 噼里啪啦在线观看免费完整版视频 | 亚洲视频免费| 国产精品久久久久一区二区| 91精品美女| 亚洲1区2区| 国产第四页| 日韩人妻av| 高清无码自慰| 精品无码一区二区三区狠狠| www.热久久| 免费看无码| 91人妻人人澡人人爽人| 人妻互换一二三区激情夏日彩春| 1区2区3区视频| 午夜不卡久久精品无码免费| 久久在线视频免费观看| 91精品国产高清一区二区三区| 亚洲AV无码日韩精品影片| 婷婷丁香六月| av免费播放| 99热在线观看| 五月开心播播网| 丁香五月激情综合| 国产精品成人va在线观看| 丁香五月激情在线观看| 高潮影院在线观看| 天天综合精品| 日韩欧美熟妇| 精品国产精品国产偷麻豆| 人人做人人爽人人爱| 日日鲁鲁鲁夜夜爽爽狠狠视频97| 中文字幕乱码亚洲精品一区| 午夜av在线| 999久久久国产精品| 日韩蜜桃视频| 欧美激情精品久久久久久变态| 欧美性爱综合| 久久久久亚洲av无码专区体验| 日本潮喷| 国产精品传媒视频| 六月伊人| 亚洲精品人妻无码| 妺妺窝人体色WWW在线观看婚闹| 国产精品扒开腿做爽爽爽A片唱戏| 五月丁香婷婷开心| 精品久久久无码| 无码少妇精品一区二区免费动态| 91久久国语露脸精品国产高跟| 国产熟女一区| 久久久99精品免费观看| 日韩一级片网站| 不卡中文一二三区| 精品成人av一区二区三区| 懂色一区二区| 人人爽人人操| 少妇大叫太大太粗太爽了A片| 欧美福利在线| 99久久精品日本一区二区免费| 懂色AV一区二区三区免费看| 五月丁香激情在线| 国产熟女熟妇| 西西4444www无码国模吧| 久久久久| 欧美一区二区三区不卡| 亚洲V国产V欧美V久久久久久| 国产夫妻在线视频| 在线观看黄色小说| 亚洲高清久久| 亚洲无码在线一区| 综合AV第一页| 麻豆精品一区| a网站在线观看| 久久国产一区二区三区| 性做久久久久久| 国产精产国品一二三在观看| 亚洲熟妇AV乱码在线观看| 国产无码精品在线观看| 国产精品毛片VA一区二区三区| 四虎影视在线观看| 无码人妻精品一区二区99| 麻豆AV一区二区三区| 国产婷婷成人久久av免费高清| 日韩精品中文字幕视频| 无套内谢的新婚少妇国语播放| 亚洲无码一级| 欧美国产激情| 亚洲国产精品视频一区| 精品一区二区三区免费毛片爱| 天堂在线| 欧美成人猛片AAAAAAA| 日产精品一线二线三线芒果| 欧美一级免费在线| 无码毛片免费| AV一级毛片| 国产亚洲精品久久久久久豆腐| 欧美色综合色| 久久一区| 色狠狠色噜噜AV天堂五区| 在线人妻| 国产黄大片在线观看画质优化| 五月婷婷丁香| 日韩电影免费在线观看中文字幕| 国模无码在线| 亚洲中文字幕在线观看| 亚洲精品www久久久 | 欧美性受XXXX黑人XYX| 天天爽夜夜爽人人爽| 九九大香蕉| 国产剧情av在线播放| www.国产色| 亚洲欧美一区二区三区在线观看| 又大又粗又硬又大又爽少妇毛片| 久久久老熟女一区二区三区| 欧美日韩久久精品| 99人妻| 亚洲AV毛片| 熟妇无码精品中文字幕夜夜爽| 精人妻无码一区二区三区| 一区二区视频在线播放| 亚洲精品天堂| 香蕉大视频一二三区乱码| 精品99久久久久成人| 一个色综合导航| 91福利视频网站| 国产免费性爱视频| 日本天堂在线| 日本不卡高字幕在线2019| 人妻 奶水 中文字幕| 成人午夜视频免费观看| 玩弄人妻少妇500系列视频| 日韩一区二区三区四区五区| 国产一级特黄aaa大片| 亚洲无AV在线中文字幕| 女同做爱视频| 久久黄片| 噜噜噜久久亚洲精品色情| 美女一区二区| 激情小说av| 中文字幕丰满人妻| 插插插色综合| 丁香婷婷久久久综合精品国产| 亚洲欧美日韩在线不卡| 三级中文| 日韩免费电影| 亚洲精品黄色| 久久国产一区二区| 久久av高潮aV| 影音先锋久久久久AV综合网成人| 国产综合福利| 国精品无码一区二区三区| 综合一区二区| 国产无码小说| 日本精品在线视频| 欧美成人免费| 最近中文字幕在线中文视频| 男人亚洲天堂| 办公室少妇激情呻吟A片在线观看| 日本少妇诱惑| 黄色av网| 99精品久久99久久久久| AA片在线观看视频在线播放| 免费亚洲成人电影| 国产做爰视频免费播放| 欧美亚洲精品天堂| 欧美高清无码视频| 午夜视频| 成人一二三四区| 色噜噜狠狠一区二区三区四区| 亚洲AV毛片成人精品| 国产在线精品一区二区三区| 亚洲色综网| 久久久久国产精品一区二区| 亚洲欧美国产日韩字幕| 极品人妻VIDEOSSS人妻| 国产三级在线| 色综合婷婷| 日本啪啪视频| 无码人妻丰满熟妇毛片| 婷婷狠狠干| www.婷婷| a在线观看| 亚洲AV无码成人毛片一级网站| 亚洲无码性爱| 日韩成人影视在线观看| 亚洲国产av网站| 风流少妇A片一区二区蜜桃| 最近免费中文字幕MV在线视频3 | 欧美一区二| 国产高清免费| 亚洲视频一二三| 在线久草| 激情五月丁香综合| 国产无码H| 欧美精品久久久久久| 日本精品成人网站| 日韩精品一区二区三区在线播放| 色xxx| 国产又黄又爽| 精品视频一区在线观看| 顶级欧美丰满熟妇XXXXX视频| 国产精品久久久久久白浆色欲| 中文欧美日韩| 激情五月婷婷丁香| 丰满熟妇乱又伦| 国产无码在线观看一区二区| 国产欧美一区二区三区精华液好吗| 亚洲一区二区在线| aaa级久久久精品无码片| 亚洲欧美日韩人妻| xxxxx日韩| 欧美精品乱码99久久蜜桃| 中文字幕日本精品人妻| 五月综合激情| 亚洲电影一区| 三级网站免费观看| 亚洲熟女一区| 日韩三级在线| 色五月激情五月| 久久午夜视频| 精品人妻午夜一区二区三区四区| 色欲午夜无码久久久久久张津瑜 | 亚洲无码AV免费在线观看| 欧美激情综合五月色丁香| 亚洲无码高清视频| 国产视频污在线观看| 91在线欧美| 免费在线观看你懂的| 国产一区二区三区无码| 农村妇女7777777视频| 久久男人的天堂| 亚洲黄色影院| aaa级久久久精品无码片| 日韩一区二区在线观看视频| 免费人成在线观看| 国产精品福利在线| 综合久久99| 欧洲av在线| 欧美一色| 青青草成人免费| 精品无码少妇| 国产不卡一区| 97成人电影| 久久这里只有精品9| 2025av天堂| 欧美一色| zzijzzij亚洲日本少妇| 四虎一区二区| 97精品人人A片免费看| 五月综合激情婷婷六月色窝| av一区+二区在线播放| AV无码网| 国产精品不卡一区二区三区| 日韩高清无码一区| 国产精品91在线| 无码一区三区| 国产乱子伦精品无码码专区| 欧美性大战| 国产精产国品一二三在观看| 亚洲专区第一页| 亚洲激情人妻| 欧美69久成人做爰视频| 午夜日韩福利| 91日本视频| 亚洲熟妇xxxx| 亚洲婷婷综合网| 无码人妻精品一区二区蜜桃视频| 国产熟女av| 人妻丰满精品一区二区A片| 亚洲乱码日产精品BD| 白天操晚上操天天操| 一区二区视频在线播放| 久久国产一区二区三区| 欧美激情久久久| 国产又黄又粗| 黄色AV三级| 无码天堂| 国产欧美一区二区三区鸳鸯浴| 国产精品无码久久| chiansea老熟老妇3乱| 日韩a片网址| 中文字幕狠狠干| 夜夜穞天天穞狠狠穞AV美女按摩| 国产无码一二区| 尤物天堂| 亚洲熟妇无码另类久久久| 日本蜜桃视频| 97精品人人妻人人| 99一区二区三区| 亚洲AV综合一区| 欧美成人精品A片免费一区99| 特级西西西4444大胆无码| 丁香五月网| av毛片无码| 一区二区中文字幕| www.日日| 日本熟女色| 玩弄人妻少妇500系列视频| 高清无码色| 色一情一乱一伦一区二区三区| 国产又粗又猛又爽又黄的小说软件| 丝袜五月天| 性按摩玩人妻HD中文字幕| 色呦呦在线观看视频| 亚洲av第二区国产精品| 国产AV一区二区三区日韩| 久久精品国产亚洲AV无码四区| 日韩AV网站在线| 国产伦久视频免费观看视频| 超碰人妻中文字幕| 麻豆一级| 精品人妻午夜一区二区三区四区| 亚洲一区二区三区四| 亚洲综合视频| 欧美黄色精品| 欧亚乱色熟一区二区三四区| 欧美特级黄片| 孕妇AV在线| 99精品久久久久久中文字幕| 日本在线色| 噜噜噜亚洲色成人网站| 国产精品第| 亚洲视频在线观看网站| 天堂一区二区三区| 久久精品国产77777蜜臀| 国产电影一区二区三区| 久久久无码精品人妻一区二区 | 97AV超碰| 无码久久久久久| 精品久久艹| A片试看120分钟做受视频红杏| 国产成人黄色| 欧美日韩电影一区二区| 国产欧美一区二区三区另类精品| 欧美色图首页| 丁香五月婷婷六月| 激情综合丁香五月| 人人爽人人草| 天天操天天插天天干| 久久国产视频精品| 国产又爽又黄无码无遮挡在线观看| 九九在线视频| 亚洲AV无码久久精品狠狠爱浪潮 | 久久久精品免费| 99网| 日韩电影一区| 国产人妻777人伦精品HD| 亚洲成人AV片| 日韩黄色av网站| 午夜久久久久| 精品人妻伦九区久久AAA片| 变态另类视频一区二区三区| 丁香五月av| 精品国产一区二区三区蜜奴| www.中文字幕.com| 草久影院| 久久国产麻豆| 国产综合福利| 97色吧| av夜色| 国产无码高清在线观看| 中文字幕3区| 久久蜜桃视频| 日韩视频在线免费观看| 欧美日韩操| 国产第二区| 国产一区二区三区免费看| 成人在线高清| 日韩人妻高清| 综合久久99| 亚州综合| 五月天亚洲av| 超碰人人操| 美日韩中文字幕| 成人丝袜激情一区二区| 亚洲午夜在线| 久久e| 欧美性生交XXXXX无码小说| 99久久国产宗和精品1上映| 成人精品视频99在线观看免费| 欧美交换配乱吟粗大25P| 欧美性生交XXXXX无码小说| 国产无套精品一区二区| 国产精品久久久久9999小说| 婷婷五月综合久久中文字幕| 日韩一级| 第一影院| 日韩一区二区不卡| 制服 丝袜 综合 日韩 欧美 | 日本A片内谢少妇一区二区| 国产精品无码一区| 午夜不卡久久精品无码免费| 婷婷成人基地| 欧美视频四区| 91乱伦| 成人免费在线播放| 人人妻人人人| 亚洲AV无码成人精品一区色欲| 国产精品沙发午睡系列| 成 人 黄 色 免费 观 看| 午夜在线| 国产国产乱老熟女视频网站97| 91精品久久久久久久| 亚洲无AV在线中文字幕| 国产gv在线| 少妇人妻丰满做爰XXX| a级免费视频| 精品午夜久久| 真实的国产乱XXXX在线| 无遮挡国产高潮视频免费观看| 精品人妻午夜一区二区三区四区| 一区二区三区久久精品| 家庭乱伦 - 草泥马视频| 国产黄色电影一区| 亚洲欧洲中文日韩久久AV乱码| 国产亚洲色婷婷久久99精品9j| 无码人妻丰满熟妇啪啪| 国产精品a无线| 日韩一区网站| 亚洲熟妇女| 亚洲精品推荐| 欧美激情性做爰免费视频| 色呦呦app| 大学生高潮无套内谢视频| 免费观看已满十八岁电视剧高清版| 天天爽天天爽夜夜爽毛片| 国产成人精品一区二三区熟女在线| 欧洲成人午夜精品无码区久久| 亚洲国产精品一区二区成人片国内| 久久久综合久久久| 草草浮力影院| 四虎成人精品在永久在线无码观看| 国产中文字幕一区二区三区| 夜夜综合| 丰满少妇乱A片无码| 日韩av综合| 国产乱子轮XXX农村| 亚洲乱码精品久久久久..| 日韩青青草| 久久久人妻| 精品久久国产| 亚洲av网站大全| 国产成人一区二区三区| 久久人妻熟女一区二区| 久久久www| 成色P31S是国精产品吗| 亚洲熟妇AV在线观看| 亚洲欧美中文字幕| 日本免费久久| 欧美二三区| 精品一二三四区| 亚洲中文字幕无码av永久| 国产日韩精品一区二区三区| 国产一区二区视频免费观看| 亚洲中文字幕AV在线| 欧美性生交XXXXX无码小说| 久久福利导航| 四虎官网| 在线观看免费人成视频| 欧美a在线观看| 人人妻人人上| 中文不卡av| 人与禽A片啪啪| 欧洲色区| 欧美性色A片免费免费观看的| 亚洲精品国产成人| 开心播播网| 一本之道高清无码视频| 7777理论片午夜无码| 四虎影院最新网站| 丁香五月婷婷在线| 色呦呦一区二区| zzijzzij亚洲日本少妇| 日韩无码小视频| 久久亚洲国产成人精品性色| 黄色成人在线视频| 欧美精品www| 日韩免费黄片| 亚洲AV丰满熟妇在线播放| 最新中文字幕av| 在线免费观看黄色av| 中文字幕 国产精品| 四虎影院观看| 最新日韩欧美| 91在线一区| 日韩精品123| 亚洲欧洲天堂| 五月激情综合| 国色天香成人网| 久久成人在线| 四川60岁老阿姨叫的没谁了| 超碰在线| 午夜激情网站| 中文字幕人成人乱码亚洲电影| 日韩综合在线| 亚州综合视频| 国产自产一区二区| 日韩大片免费观看视频播放| 久久99精品久久久久久国产越南| 人妻妺妺窝人体色WWW聚色窝| 一本一道久久a久久精品蜜桃 | 欧美日本中文字幕| 国产成人精| 中文字幕免费av| 97精品人妻一区二区三区蜜桃| 污污内射在线观看一区二区少妇| 日韩在线欧美| 禁久久精品乱码| 一级内谢又粗又黄| 中文字幕一区二区三区夫目前犯| 成 人 黄 色 免费 观 看| 无码人妻精品一区二区三| 超碰日本| 国产精品久久久免费视频| 欧美日韩大片| 亚洲国产精品SUV| av免费在线不卡| 久久精品国产精品亚洲毛片| 在线播放亚洲无码| 亚洲成年人在线| www.人妻.com| 色久优优| 国产8区| 在线观看黄片| 欧美调教| 亚洲色av| 人妻熟妇视频| 国产亚洲精| 久久熟妇| 日本午夜电影网| 国产精品99久久久久久久女警 | 免费99精品国产自在在线| 99热影视国产一区二区三区| 丁香五月婷婷六月| 国产精品第一国产精品| 色窝窝无码一区二区三区成人网站| 色一情一区二区三区四区| 精品三级国产| 天天插日日操| 国产伊人网| 国产成人精品一区二三区熟女在线| 国产一区二区三区四区在线观看 | 国产中文久久| 午夜福利一区二区| 欧美黄色网页| 亚洲一区二区无码| 黑丝无码在线| EEUSS鲁片一区二区三区| 精品无码少妇| 午夜巴黎| 青青草av| 人人妻人人玩人人爽| 无码少妇高潮喷水A片免费| 欧美日韩高清在线| 日韩一卡二卡| 欧美大片| 天天做天天摸天天爽天天爱| 涩里番免费一区二区三区| 欧洲中文字幕日韩精品成人| 蜜桃丰满熟妇av无码区不卡| 夜夜躁婷婷一区二区三区| 国产三级在线观看完整版| 久久精品亚洲天堂| 鲁鲁狠狠狠7777一区二区| 丁香五月激情综合| 亚洲成人一二三| 国产精品一区二区网站| 色偷偷AV亚洲男人的天堂| 试看120秒一区二区三区| 免费观看黄色录像| 天海翼一区| 天天插天天操| 乱熟女高潮一区二区在线| 一道本在线视频| 亚洲精久久| 欧美性生交XXXXX无码小说| 91精品国产乱码久久久久| 国产污视频在线| 麻豆传媒在线免费观看| 国产成人一区二区三区在线观看| 无码视频在线| 亚洲国产精品尤物YW在线观看| 精品一区日韩| 亚洲综合憿情五月色丁香色婷婷| 亚洲情综合五月天| 蜜桃视频| 五月综合激情| 日韩人妻精品一区二区三区视频| 亚洲欧洲免费视频| 国产成人亚洲精品| 午夜精品久久久久久毛片| 亚洲一区二区三区影院| avtt香蕉久久| 国产中文字幕一区| 久久久久亚洲AV无码专区| 久久精品9| 欧美成人AAA片一区国产精品| 成人中文网| 亚洲一本| 国产偷人爽久久久久久老妇APP| 国产一级内射| av天堂.com| 大香蕉网在线| 亚洲无码激情| 99网| 窝窝视频在线观看| 国产亚洲精品久久久久久豆腐 | 欧美精品少妇| 青苹果影院| 国产精品亚洲一区二区无码| 操久久久| 午夜AV影视| 国产精华一区二区三区| jlzzjlzzjlzz亚洲女| 国产精品视频WWW| av不卡一区二区三区 | 几个东北熟妇的性经历| 国产精品久久亚洲7777| 江苏少妇性BBB搡BBB爽爽爽| 欧洲无码AV| 日本一道在线| 麻豆爱爱视频| 91乱伦| 精品91| 无码少妇高潮喷水A片免费| 97三级| 无码电影免费观看高清| 91在线视频国产| 日韩精品一区二区三区视频| 国产精品一区二区三区免费| 在线观看亚洲专区| 中国女人内射6XXXXX| 色窝视频| 一区二区三区小说| 在线观看黄色片| 极品av在线| 亚洲国产精品久久久久婷蜜芽 | www.国产视频| 亚洲天堂99| 熟女乱伦一区| 四虎少妇| 五月综合激情| 日本少妇三级| 国产变态另类| 图片区 小说区 区 亚洲五月| 九色精品视频| 中文字幕丰满人妻无码专区| 亚洲国产97在线精品一区| 午夜视频网址| 一区三区在线观看| 91精品视频在线| 国产毛片精品国产一区二区三区| 免费观看无码视频| 99久久国产宗和精品1上映| 日本一区二区三区在线观看视频 | 人妻无码精品| 秋霞免费视频| 日韩在线视频一区| 国产精品熟女| 久草久草久草久草| 日韩高清不卡无码| 看真人视频一级毛片| 日韩精品电影| 色色色人妻| 99伊人| 日韩欧美性一区二区三区| 成人免费网站www污污污在线看| 国产V亚洲V天堂无码精品| 草久久久| 亚洲欧美精品一区二区三区| 亚洲国产免费| 一区二区三区日韩| 日韩黄色电影免费观看| 国产精品久久久久久久久久| 天天摸天天操天天日| 99久久久久无码国产精品免费 | 云南一网约车司机中500万大奖 | 青青草福利| 欧美精品第一页| 波多野结衣av一区二区三区| 国产91熟女高潮一区二区| 国产一卡二卡在线观看| 六月婷婷综合网| 欧美日韩一区二区三区成人免费| 精品一区二区三区久久| 在线播放福利| 亚洲欧美日韩在线不卡| 内射无码专区久久亚洲| 亚洲一级黄色| 亚洲无码视频一区| 亚洲3p| 日韩三级网| 国产精品亚洲一区二区无码| 日本黄色中文字幕| 成人小说综合网| 日韩毛片免费视频| av日韩精品| 一区二区三区免费看| www.狠狠干| 91高清在线| 精品国产乱码久久久久久久| 欧美少妇一区二区三区 | 亚洲亚洲人成综合网络| 婷婷丁香成人| 狠狠躁夜夜躁| 国产精品免费久久久久久久久拳交 | 干人妻视频| 成人美女网| 丁香五月成人| 婷婷六月丁| 国产精品99久久久久久www| 国产Av直播| 午夜少妇在线观看视频| 天天插日日操| 九九久久精品| 国产精品久久一区| 久久乐精品| 国产一区二区三区在线观看免费| 国产三级不卡| 欧美日韩综合一区二区| 国产精品激情AV久久久青桔| 人妻久久一区二区| 人人爽人人操| 国产 欧美 日韩| 国产精品美女| 99久久综合国产精品二区| 亚洲色中文字幕| 日韩精品在线视频观看| 四虎影视成人| 超碰福利在线| 亚洲无码人妻在线| 日本精品视频在线| 色播久久| 性欧美video另类hd野外| 国产亚洲精品久久久久苍井松| 久艹网| 亚洲欧美成人一区二区老牛影视| 免费无码在线看| 五月婷婷开心网| 久久久午夜| 囯产精品一品二区三区| 久久久亚洲一区二区三区| 叼嘿视频| 日韩欧美在线一区| 亚洲欧美久久久| 免费无码毛片一区二三区| 国产群交| 亚洲国产色图| 国产农村妇女精品一二区| 亚洲色一区| 999久久久国产精品| 久久99久久99精品免费看小说| 欧美变态口味重另类在线视频| 无码成人AV在线看免费| 97精品人妻一区二区三区蜜桃 | 亚洲精品成人片在线观看精品字幕| 欧美另类天堂| 国产美女被高潮免费网站| 狠狠激情| 色婷婷成人做爰A片免费看网站| 四虎一区二区| 色福利网| 懂色av色香蕉一区二区蜜桃| 色综合国产| 欧美极品少妇xxxxx| 亚州av电影| 亚一区二区| 日本福利一区二区| 天堂成人在线| 你懂的视频| 丁香七月婷婷| 色婷婷六月天| 新搬来的白领女邻居| 亚洲国产精品SUV| 人人妻人人做| 久久综合国产| 一区二区操逼视频| 在线不卡| 99成人在线视频| 性做久久久久久久| 四虎在线网址| 四虎永久在线精品免费网址| 91香蕉嫩草| 久热无码视频| 国产亚洲av片在线观看18女人| 在线免费观看AV不卡| 综合五月天| 久久精品夜| 欧美日韩在线精品| 欧美性猛交 XXXX 乱大交| 午夜理伦网站| 人人妻人人澡人人爽少妇| 丁香五月婷婷在线| 欧美日韩黄色| 精品亚洲国产成AV人片传媒 | 亚洲狠狠爱| 欧美另类熟妇| 精人妻无码一区二区三区| 国产精品久久久爽爽爽麻豆色哟哟| 202丰满熟女妇大| 性av天堂| 日韩成人精品一区二区| 国产精品污视频| 亚洲亚洲人成综合网络| AA片在线观看视频在线播放| 女人被男人吃奶到高潮| 成人做爰A片免费看网站找不到了| 亚洲中文字幕日本| av黄在线观看| 国产AV无码专区亚洲AV毛片搜| 亚洲AV少妇熟女综合网| 夫妇交换刺激做爰| 国产人人干| 蜜臀久久99精品久久久久久宅男| 中文字幕一区二区三区夫目前犯| 日本欧美成人片AAAA| 亚洲AV免费看| 国产古装妇女野外A片| 中文字幕按摩做爰| 精品人妻在线视频| 人人妻人人搞| 爆操黑丝美女| 欧美 日韩 成人| 国产特级毛片aaaaaa| 无码三级在线观看| 国产精品一区二区三区不卡| 7799日日夜精品日日夜精品| 乱精品一区字幕二区| 特级毛片www| 日韩黄色片在线观看| 亚洲3p| 午夜性爱| 精品国产Av一区二区三区| 一区二区三区激情| 老熟女乱伦视频| 国产天堂av| 99热国产精品| 五月天开心激情| 日本欧美成人片AAAA| 丁香五月在线| 狠狠人妻久久久久久综合| 亚洲一二三四区| 老熟女影院| 噼里啪啦完整版中文在线观看| 白嫩白嫩国产精品| 日韩无码一卡二卡三卡| 欧美福利一区| 久久精品亚洲| 狠狠躁夜夜躁人人爽天天高潮| 性做久久久久久久| 色欲www| 狠狠干2019| 无码一区二区三区四区| 欧美精品日韩精品| 粉嫩AV久久一区二区三区| 精品国产乱码久久久…| 人人超碰在线| 麻豆亚洲一区| 青草青草视频2免费观看| 中文字幕韩日| 人妻中文在线| 久久无码高清视频| 中文区中文字幕免费看| 亚洲三级在线观看| 久久福利导航| 久久亚洲国产成人精品性色| 亚洲激情久久| www.五月婷婷.com| 中文字幕精| 麻豆蜜臀| 不卡欧美| 都市激情亚洲| 人人爱人人做| 高潮喷水在线| 久久综合一本| 乱岳熟女50岁| 影音先锋久久久久AV综合网成人| 中文字幕二| 伊人成人在线| 亚洲电影在线观看| 中文一区在线观看| 精品国产一区二区三区无码| 影音先锋女人aV鲁色app| 99网| 麻豆一级| 久久xxxx| 精品综合| 久久久无码精品亚洲国产| 日韩综合在线| 亚洲成人AV片| 无码人妻一区二区三区四区| 少妇AB又爽又紧无码网站| 中文字幕亚洲精品| 伊人狠狠| 国产欧美日韩综合精品一区二区| 久久成人影片| 久热精品在线观看| 大战熟女丰满人妻AV| 国产三级日本三级在线播放| 精品一区在线| 欧日AV| 国产精品入口| 在线综合色| 成人无码精品1区2区3区免费看| 成人毛片无码一区二区三区| 亚洲va| 日韩中文字幕在线观看| 韩国午夜| 亚洲中文字幕第一区| 亚洲av人人澡人人人夜| 亚洲三级黄色片| 日韩AV成人网| 74影院| 人妻体内射精一区二区| 蜜桃五月天| 欧美老熟妇乱大交xxxxx| 久久亚洲私人国产精品| 欧美1区2区| 欧美日韩亚洲天堂| 欧美一区二区三区在线| 人妻少妇偷人精品无码中文字幕| 丰满少妇猛烈A片免费看观看| 国产免费无码一区二区| 国产精品三级在线观看无码| 五月丁香婷婷爱| 六月婷婷五月丁香| 欧美日韩色色色| 欧美日韩精品在线| 精品一二三区久久AAA片| 精品国产一区二区三区四区阿崩 | 欧美成人高清| 无码一级a免一级a做免费线看| 91插逼| 乱色精品无码一区二区国产盗| 免费一看一级毛片| 日韩一区欧美| 苍井空浴缸大战猛男120分钟| AV小说在线观看| 国产av色图| 伊人久久大香色综合| 伊人二区| 伊人久久大香线蕉综合75 | 日韩中文字幕国产| 99精品国产99久久久久久97| 日韩大片在线观看| 亚洲欧美综合一区二区| 五月丁香中文| 久久久精| 中文字幕久久久| 嗯啊灬啊灬灬欧美视频| 中文字幕在线观看网站| 欧美激情久久久| 亚洲AV免费在线观看| 欧美 日韩 综合| 欧洲精品视频在线观看| 激情小说图片区| www.久| 国产女主播喷水视频在线观看| H0930人妻斩@熟女| 亚洲AV无码成人WWW| 国产自产21区| 欧美日韩亚洲国产综合| 久久不卡AV| 日韩人妻一区| 国产精品亚洲五月天丁香| 蜜臀aⅴ国产精品久久久国产老师| 欧美多p| 午夜AV小电影| 国产精品麻豆欧美日韩WW| 无码人妻一区二区三区线花季软件| 久久成人毛片| 日韩少妇一区二区三区| 内射爽无广熟女亚洲| 粉嫩AV久久一区二区三区| 色小说综合| 成人动漫久久| 超碰一区二区三区| 黑人极品videos精品欧美裸| 欧美日韩在线一区| 免费日韩av| 久久久国产精品人人片| 夜夜爽77777妓女免费下载| 国产精品一二三区视频出来一| 精品视频一区二区三区四区| 欧美色xxx| 欧美性爱精品一区二区| 亚洲精品人妻| 国产亚洲精品美女久久久| 91无码在线视频| 九九精品在线| 国产精品久久久久久久av超碰| 久久亚洲无码| 亚洲熟妇AV在线观看| 丁香花在线影院观看在线播放 | 国产在线视频卡一卡二| 三级视频无码| 无码国产精品一区二区高潮| www.日韩精品| 婷婷色在线视频| 中文字幕有多少字| 久久精品国产精品| 久久小说网| 国产精品久久久久久白浆色欲| 性爱国产| 亚一区二区| √天堂午夜无码久久va| 99久久精品免费看国产| 疯狂做受XXXX高潮A片| 欧美三日本三级少妇三级99| 国产熟妇的荡欲午夜视频| 国产亚洲色婷婷久久99精品9j| freehd人妻少妇xxxx| 国产精品永久免费| 国产伦精品一区二区三区最新章节| 国产精品成人网站| 欧洲av在线| 丁香七月婷婷| 成人久久免费视频| 尤物视频网站| 中文字幕一区二区三区日韩精品| 天天做天天摸天天爽天天爱| 老美AA片| 成人无码精品1区2区3区免费看| 无码激情AAAAA片-区区| www.欧美日韩| 91精品人妻一区二区三区蜜臀| 精品国产影院| 97免费人妻| 丰满熟妇猛性bbwbbw| 国产精品呻吟久久| 国内AV无码| 午夜精品福利在线| 精品少妇人妻AV无码专区偷人| 在线手机av| 国产成人在线视频| 亚洲一级无码| 欧美精品系列| 成人无码一区二区| 99久久久久久久| 国产欧美日韩| 日韩无码免费视频| 日日视频| 久久性爱视频| 国外亚洲成AV人片在线观看| 亚洲AV永久| 亚洲AV无码成人精品区一本婷婷| 嗯啊好爽视频| 久久久一本| 无敌电影网| 亚洲成a人片在线观看www| 人妻无码中文久久久久专区| 熟妇人妻系列aⅴ无码专区友真希| 成人婷婷网色偷偷亚洲男人的天堂 | 99久久久无码国产精品衣服| 成人做爰黄A片免费看直播室男男| 欧美激情第二页| 日韩大香蕉| 91高清视频| 国产av影视| 国产精品久久久久毛片软件| 熟女一区二区| 久久久精品免费视频| 国产无码专区| 亚洲一本| 香蕉视频你懂的| 女同一区二区三区免费| av 一区二区三区| 午夜福利视频欧美| 国产欧美熟妇另类久久久| 欧美一级特黄AAAAA片竹菊| 内射人妻无码| 鲁丝av鲁丝一鲁丝二鲁丝三| 中文字幕日产A片在线看| 亚洲精品无人区| 亚洲人妻网| 熟女A片精品一区二区免费看| 国产精品久久久久久久久午夜福利| 不卡欧美| 欧美日韩成人| 日韩在线视频免费观看| 色婷婷综合在线| 99国产精品久久久久久久久久久| 国产成人综合亚洲| 老熟女影院| 国产污视频网站| 亚欧美日韩| 成人av在线网址| 国产99精品视频| 亚洲四虎影院| 国产精品美女在线| 国产精品久久久久久久一区二区| 久久精品久| 熟女性饥渴一区二区三区| 无码视频免费看| 久久a视频| 精品国产乱码久久久…| 亚洲三级片视频| 国产精品久久777777| 久久不卡| 91久久久久久久久久久久| 中文字幕久久精品| 人妻丰满精品一区二区A片| 亚洲精品国产电影| 最新日韩无码| 亚洲精品免费Av| 人人澡人人爽| 亚洲资源AV| 日韩免费电影|