備案號(hào):遼ICP備19007957號(hào)-1

![]() 聆聽您的聲音:feedback@highmark.com.cn企業(yè)熱線:400-778-8318

聆聽您的聲音:feedback@highmark.com.cn企業(yè)熱線:400-778-8318

Copyright ?2015- 海馬課堂網(wǎng)絡(luò)科技(大連)有限公司辦公地址:遼寧省大連市高新技術(shù)產(chǎn)業(yè)園區(qū)火炬路32A號(hào)創(chuàng)業(yè)大廈A座18層1801室

Revise those highlighted in yellow. Do not need to highlight your revision. Revise the long sentences to short ones.

RESEARCH ON DIVIDEND POLICY IN UK, US, JAPAN AND CHINA

Insert name

Instructor’s name

Course

Institution

Location

Date of submission

Table of contents

Contents

Executive Summary 3

1.0 Introduction 4

1.1 Report outline 4

1.2 Research questions 5

1.3 The research objectives 5

2.0 Literature review 6

2.1 Describing dividend policies 6

2.2 Underlying issues with dividend policies 7

2.2.1 Dividend policies in the developed economies 7

2.2.2 Dividend policies in developing economies 8

2.2.3 Regional differences in dividend policies and corporate governance 9

2.3 Dividend policy signalling, decision making and judgment: client theory 10

2.4 Dividend policies and corporate value 11

3.0 Methodology 14

4.0 Analysis / Discussions 15

4.1 Analysis 15

4.1.1 McDonalds: the United States representation of dividend policies 15

4.1.2 Tesco: a United Kingdom perspective of dividend policies 17

4.1.3 The 21 Lady: the Japanese description of dividend policies 18

4.1.4 China Construction Bank: a Chinese case of dividend policies 19

4.2 Discussion 20

4.2.1 Interpretation of findings 20

4.2.2 Effects of dividend policies on corporate and brand value 22

5.0 Conclusion 23

References 24

Table of figures

Figure 1 Capital structure models influencing dividends and divided policies 8

Figure 2 Trends on GDP and growth of returns 9

Figure 3 MCD dividends 16

Figure 4 21 Lady return, dividend and price 18

Figure 5 CCB dividend histories 19

Figure 6 Dividend statistics 20

In this report, the dividend policy is being described and the choice of companies is also provided for the analysis on dividend policy. With this, this report provides a literature review in which the directions for the report are provided in terms of the suggested empirical findings that dividend policy will be having. Equally, the report provides valuation and comparative descriptive data as suggested and documented in the methodology. Therefore, this report follows the avenues of descriptive data, in analysing the effects of shareholder composition and the corporate value from the dividend policy. Equally, with the sighted references, this report compares its findings on a number of literature text and website documentation from which the findings are related. Therefore, dividend policy is being analysed and provided as the major concern in the management of attitudes for investors and states. In particular, it is noted that dividend policy is a very important dimension in the management of investor composition and corporate values as documented by the adoption of the General Accepted Accounting Principles and the International Financial Reporting Standards.

The main interest that is developed with investments is majorly a concern of returns (Li & Zhao, 2008). Thus, there will be two positions from which investor will be standing at the financial ending of investment periods, this is the suggestions of whether to receive their investment returns or equally reinvest what they have made in the year of operations back to risk gaining more in the next financial year. Looking at this position, the interest that might be existing with the repayment and the reinvestment of the dividend earned will all be dependent on the management that the investment has been receiving. On a personal level, it is, therefore, noted the investment, reinvestment and enjoying return is taken based on the rationality that the investor will be having. In this case, the situation that is presented with the developed and the devolving would will, thus, be familiar on the return on investment as dividend payments (Short, Zhang & Keasey, 2002).

With the interest now highlighted on the issues of dividend payments, this report will, thus, focus on the identification of dividend payment in a more detailed perspective. In essence, the material suggestion defining this term all revolve around the return that the investor and this time they are referred to as shareholders will be getting based on their investment positions in the company of choice (Martins & Novaes, 2012). Thus, the dividends are identified as a return that is only guaranteed with the performance of the company during the financial year. Therefore, with the intention that is identified with the motivation that is validly attached to investor returns, this text seeks to register an analysis on the dividend payment ratios in four different economies of interest. These are the United States, the United Kingdom, the People’s Republic of China, and the nation of Japan. In this measure, the interest develops with the intentions to assess the validity of investing as a shareholder in these four nations. Looking at the observations that are made by Cheng, Ioannou and Serafeim (2014), the nature and the position that is developed with the dividend policy is one that is taken from the general environment that the government regulations will be taking into account.

Therefore, the development that is taken into considerations will be inclusive of the need to examine three directions of dividend policies. First, this report will outline them in its literature review by analysing these policies on dividends, tax and corporate governance that the four economies have (Roberts & Whited 2012). Thus, with this composition of the report, it will focus on the reason behind the difference in these policies within the four countries. Keeping in mind that the United States and the United Kingdom have mature grown up economy, the dividend policy from this direction will be developed from the angles of the developed economy perspective (Mitton, 2004). On the other hand, Japan will equally be one good example of a developed economy except for this report, the economy of Japan will serve to provide an example of the performance of policies within diffract geographical regions. Therefore, on the comparative edge the Republic of China will be taken as the position from which the report will examine the performance of dividend and corporate policies in a developing economy.

From this position, the interest will be developed in the highlighting of the methodology that the report will take the conduct of the research into dividend policy. With a brief interest that this report will seek to provide the direction that it will take in the gathering of information. From this, the report will move to the fourth chapter on which the findings of the analysis will be discussed in very precise details (Fatima & Abdullah, 2014). This analysis will be an equivalent of the finding position that is normally attributed to the majority of the developed research report. Thus, with the interest areas of analysis set the report, therefore, develops the following objectives and research questions for the research.

According to Bryman (2012), the research questions are described to the interest that the inquiry will be having. These are, therefore, described with the inference that normally attaches to the major interest that the report will be serving.

1. What are the differences in the dividend policies within developing and developed economies?

2. Why are there differences in dividend policies within economic regions?

3. How do dividend policies affect the position and the investment affinity of shareholders?

1. To assert that there are differences in dividend policies within different economies.

2. To develop findings on the reasons behind dividend policies.

3. To provide suggestions on the best direction for economies with differentiating and selecting of dividend policies.

In general the interest that is developed with the report outline, the research questions and the research objectives are suggested as the major points of concern from which the management and the policy setting directions of the economy will be interested in manipulating dividend policy to spur economic growth of investment capital (Callao et al., 2011).

This literature review will be developed with the management position that is suggested with a number of written materials. Thus, the assessment of the relevance of the dividend policy is assessed from this direction. This is tabled with the changes that are evidenced by the dividend policies of a variety of companies. Thus, it is noted that a number of companies will not be holding their dividend policies of a constant position (Bryman, 2012). According to Badertscher, Katz and Rego (2013), this is attached to the information that is made available with the interpretation that the investor will be having with this.

Thus, this literature review will choose to describe the dividend policy and equally seek to analyse the underlying issues that are in the markets of investments. This will equally be the position from which the value of the dividend policy will be examined from making the interest of the research questions and a research question from an analytical and descriptive research (Baird, 2014).

According to Aguinis and Glavas (2012), the description of the dividend policies will be described under the suggestion of the dividend policies relating to the distribution of return decisions. In essence, the most attractive thing of an investment portfolio to shareholders will be described as those with a structure direction of the management of returns. Thus, if the mythology from which the return of the company at the end of the year will be described as clarity and precision, the investment gradients seem to get less steep. This is attached to the suggestion that the dividend will be representing the effort made by the company in mining capital gains for their shareholders (Cheng, Ioannou & Serafeim, 2014).

Thus, the dividend policy is equally attached as a position for which the economy and the companies at play within the economy will be willing to pull such that they can attract the share investment into their portfolios. Thus, the interest that is analysed is developed along the suggestions of the competitive edge that the companies in the competitive markets have the acknowledgement of dividend policies. According to Cheng, Ioannou and Serafeim (2014), the performance of the competitive markets, in this case, the nations and the economies of the United States and the United Kingdom. Thus, in the analysis the inquiry will be about whether these nations have a dividend policy which is relevant even with the position that is attached to their competition in the market and the need to remain relevant in the eyes of investors.

On the other hand, the interest that is developed with the management of dividend policy is equally that it can be assessed from the position of shareholders receiving larger dividend payout as divided or equally the opposite (Martins & Novaes, 2012). In fact, Cheng, Ioannou & Serafeim (2014) notes that the majority of the developments that are described in this review will be assessed on the position that the shareholders have with the payments of dividends and the turnover that is exhibited with share sales. Thus, the relevance that is sought out is one that attaches to the need that the company will be having in payment of dividends in markets that is filled with turbulence in market competition and the needs to have their performance described by lucrative nature for investment (Roberts & Whited 2012).

The selection of dividend policy is positioned towards the developments that the company will be having in reference to the interest that this report tabled on the selection of dividend policies of the company. With this, it appears that the underlying issues on dividend policy are revolving on the withholding of dividend payment and the payment ratios that the company will be checking in terms of returns. Thus, it is important to note that the company will need to consider the selection of the dividend policy. This is attached to the facts that dividend policies will most likely be considered in the payment and the selection of the payments. In fact, it is noted that a number of companies will be in a position to regular and equally affect the payment of dividends and most probably get the effects from-gruntling shareholders (Brammer, Jackson & Matten, 2012).

The developed economies, in this case, the United States and the United Kingdom are known to be some of the largest financial markets. With this noted it will be important to assert that the consumers in the divide that is operated by the United States markets and the United Kingdom markets is one that will be assessed based on the developments of the models and the structure that the companies will take in dividend payments. With this, the following models attach to the payments of dividend within the free markets description of the United States and the United Kingdom (refer to Figure 1).

|

Approach in dividend policy |

Main concepts |

Determinants of dividend |

Observation |

|

Behavioral models |

Payment of dividends based on the stability that is attached to target dividends |

Current earnings in the company |

Positive expectation based on pre-determined structure |

|

Dividend signal modeling |

Decisions on dividends payment may be changed by firm management, firm with more information available in the public tend to pay less a valid as more solid role in motivate investors into a future relationship |

Current and future earnings |

Mixed reactions based on the concealing structure as attached to shareholders. |

|

Debt constraints |

Firms decrease or increase payments of dividends based on the debt constraints that they have in the financial year. |

Firm leverage or debt ratio |

Mixed based on the debt performance or the debt ratio in a particular year |

Figure 1 Capital structure models influencing dividends and divided policies

Looking at the development that are suggested by the models above, the directions that are attached to the management of dividend payment in the more developed economies seem to be leveled to the suggestions of having a more flexible position from which the companies will be in a position to evaluate and pay returns. This is a position that is seen as one liberal and bias position from which the company’s management are at the liberty and at the mercy of the performance and of the company management (Baird, 2014).

On the other divide, the description of the management of the dividend policies in the developing economies in these positions is the Republic of China. In essence, according to Cheng, Ioannou and Serafeim (2014), the number of Chinese countries that have been paid out dividends has been overly attached as very small. It is with these descriptions that the concerns of dividend payments are more or less attached as some very new dimensions in this divide. In fact, compared to the United States the performance of the companies in China is because of the difference in corporate governance that is affected by the government shareholding in the Chinese fraternity.

Having noted the difference that is attached to the performance of the companies in China, it is noted that the Chinese companies have been under the effects of a very detailed government influence. Thus, the official statement will be that the companies will not be in a position to describe less in terms of shareholder investments based on the performance of their operation in the year and the government control (Cheng, Ioannou & Serafeim, 2014). As a result, looking at the position that is suggested with the dividend policies in the developing and the less liberal markets in China, the interest that is developed is one that is seemingly on that attributes government control and private investment do not go hand in hand.

On the other extreme divide, the performance of corporate governance is one that is tabled along the suggestions of the performance of the company in terms of the geographical differences. In essence, looking at the expression that is attached to the investment in Japan, a number of concerns come out in the open. These are attached to the moves that the Japanese companies have been showing in the recent future (Bryman, 2012). In fact, more of Japanese companies are seemingly describing more values in the budgets and the expenses that they give to the corporate governance. With this in mind, the moves that are exhibited with the performance of the companies in Japan are seemingly best attached to the investment creativeness that this corporate governance offers. According to John (2015), the performance of the ‘show me the money’ corporate governance by the Japanese government, there has been a number of changes that have actually warranted the need to have them change their productivity to their growth in capital markets (Martins & Novaes, 2012). According to the extract on the figure from the Japanese minority of finance, the nation is on the verge and the path of structural profitability that has been increased with globalization.

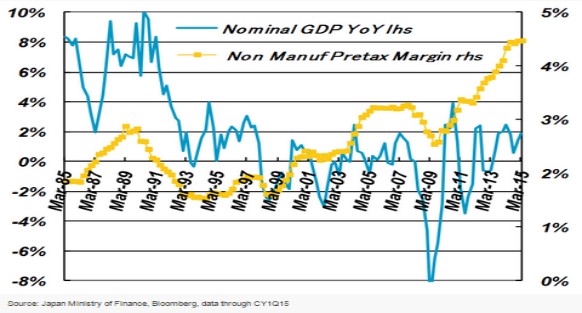

Figure 2 Trends on GDP and growth of returns

The yellow index describes that pretext margin that was attributed to the non-manufacturing companies. In this valuation, the description that is, therefore, attached to the performance of the companies in Japan is equally the one that is attached to the eventuality of a rise even with the nominal GDP rising (John, 2015).

With the interest that has been developed in the above agreements for the developing nations and the dividend policies, it will be important to format an assessment based on the signal, decision-making and the judgement that comes with dividend policies (Strebulaev & Whited, 2013). First, according to Li and Zhao (2008), the most valid position from which the dividend policies are sought after will be having in mind that the returns to investments as mentioned earlier. Mathematical finance tables this as the entry point from which the computation of the cost of equity and the dividend growths are monitored. Therefore, the position of the client theory is also directed towards the valuation of the position that is held with the clients as investors and shareholders (Short, Zhang & Keasey, 2002).

Thus, according to the client theory the main idea is that with the changing of the dividend policy the firm is most probably open to the loss of a number of clients. Looking at the marketing description of clients, the basic identification is maintained alongside the fact that the clients or the customers in the business are identified as stakeholders. This makes the company’s management and in particular, the regulators of the economy at a very particular position about five distinct characteristics on the setting of dividend policies (Li & Zhao, 2008). The first one of the theories consideration is based on the need to ensure that with dividend setting the companies will be in line with the recommendation of the avoidance of cutting into the net present valuation of the project that are in continuation. This implies that in the calculations and the administration of dividends and that of returns that are attributed to the future valuations need to be kept aside. Secondly, the theory maintains an avoidance of the dividend cuts, the need to secure equity to the shareholder equally being a very primary concern. Finally, the client’s theory on dividend policy is primarily attached to the needs to maintain the healthiest of debt ratio as well as maintain and set out the dividend payment ratio (Martins & Novaes, 2012).

Therefore, according to the suggestion of the client theory, it seems to be attached to the needs that the company will be having in ensuring that they have a well-defined and a well-structured dividend payment ratio (Short, Zhang & Keasey, 2002).

The client effect theory is, therefore, based on the above suggestion, the mechanism to which the theory has been attached to the payment and the recognition of dividends has been provided. In this position, the effects of the client theory describe that the investors will only be willing to have their intentions matched to the investments that the firms will be making. In this Bena and Li (2014) argues that the investors in the client theory effect will be seeking for a position under which their factor endowments are favourable. These are arguably the common description of the investor making ratio investment decisions with the tax implication of investment returns in mind. This will be true to assert that the relation between the stock returns which are the dividends and the tax levels is an increase one (Badertscher, Katz & Rego, 2013).

With this, investors in the higher tax brackets will seemingly prefer to invest in low-return investments such that they are tangibly liable for less tax. On the other hand, investors or shareholders in the lower tax bracket will equally choose the stock with higher dividends because they are oblivious about the tax implication based on their current affinity to lower taxes (Badertscher, Katz & Rego, 2013). This is an assumption that is equally attached to the lifestyle and the age groups that people have. The majority of the working class will hold stocks with fewer dividends based on the lower returns and the retired population seemingly constituting the higher percentage of the high return dividends in the United States and the United Kingdom currently.

Therefore, looking at the dividend policy and the structure that are suggested by the client effect theory, it will equally be very material to assess the degree and the truth of this in the United Kingdom, the United States, Japan and equally the developing economy of China. Looking at the global index on the annual dividend growths, the following transpires making this literature review develops more findings on the position of the client theory in this case. In fact, focusing on the United States as tabled with the morning standard index, the growth of portfolio seems to be stagnating to a normal after the 2007-2008 financial crises (Callao et al., 2011). On the other hand, the majority of the companies in the People’s Republic of China have been reporting a good description of portfolio growth as will be seen in the data discussion and analysis. Nevertheless, looking at the position that is described with the shareholders from China, the description is completely different from what is expected from the position of the Japanese, United Kingdom, and the United States.

Thus, with the suggestions that had been poised with the five pillars of setting the client theory and any other dividend theory, therefore, review notes that with the mindset of the clients set on identifying return with the tax liability (Badertscher, Katz & Rego, 2013). They are bound to be the very different direction of dividend policies and investment patent in the different states with different tax laws.

The majority of discussions will be primarily focused on this subheading of literature analysis. According to Chemmanur, Loutskina and Tian (2014), the corporate value of the company is what the majority of companies attach as the intangible asset position in brand value according to IFRS 3 and the goodwill equally recognizes by the regulatory framework of accounting under the IFRS 138. With this, the interest that is normally sought after is one that based on the position of a business combination (Taylor & Richardson, 2012). It will be true to assert that it is during the position that is played with the valuation is materially developed in the needs of asserting the corporate value of the company. Therefore, the corporate value is one thing that can be enhanced on the dimensions of giving the company better brand identity even with their investors. With this in mind, the question that is posed by dividend policies is, therefore, one that can equally be answered based on the needs of corporate awareness and corporate value creation.

According to Mitton (2004), the description of the corporate valuation in the United States and the United Kingdom will be materially very different from those in Asia. In the management of the free trade policies, the market of China is the one that still mainly has a number of restrictions on the management and the regulation of trade. This implies that the state control is huge in a number of the industries. In fact, based on the argument that is fronted by Taylor and Richardson (2012), the control of industries, sectors and even companies by the government is highly limited to the performance of the corporate sector. According to the argument fronted by the field of economics, this is suggested alongside the management of the brand valuation in identifying creation.

This is to link the policy effect of the dividend policy to the corporate valuation, a number of positions are noted, and these are the internal operations that guide the business a way of conduct (Aguinis & Glavas, 2012). There will equally be very important to identify with the position that is attached to the needs that the companies will be having with the identification and the recognition of the dividend policy.

Thus, with the link that has been identified in corporate value entailing the constant position that the benefits of the dividend policy to the corporate value is established. The dividend policy will be among the major concern that a company will be fronting is its brand value and the corporate identity is to sell to the shareholders. This is described along the suggestions of the dividend policy providing the shareholders with the valid position from which they will be able to assert their investment validity. Thus, according to Mitton (2004), the position from which the corporate value is influenced by the dividend policy will be positioned to the operating philosophies, and the relationships that the company have. Specifically with a very particular mission statement the organization can be positioned to the management of the maintaining of core values and share in investor management. This implies that the dividend policy can be used to fully attach and attract the investor that they will need. From this, this text will equally borrow from the suggestions that had been levelled with the intentions of the earlier literature sighting the effects that are attached to the client theory (Bena & Li, 2014).

The client theory suggested that the investors are different and have some affinity to the tax implication on returns and dividends. Thus, looking at the position that is suggested with the dividend policy, the investor will be able to know whether the returns of the company are either high or low. This will equally be a position from which the assessment of the investment can be attached to the descriptions of the need and apathy to identify with the positions of the attracting of investors. Thus, other than the attached position that is attached to the description of the analysis in the good that the dividend policies have on the corporate value. It will equally be important to focus on the suggestions that are attached to the maintenance of the dividend policies as having effects on the firm value (Martins & Novaes, 2012). In essence, according to Roberts and Whited (2012), brand value is attached as the relevance that the dividend valuation and the dividend policies have on the corporate value of the company. The position that is entirely supported by the management of the dividend is, therefore, levelled to a number of models that have been presented for the creation and the assertion of the relevance of dividends (Da, Guo & Jagannathan, 2012). One of these is the Walters model, which fully attaches the inquiry on relevance to the value of the share on which the investors are earning the dividends. Arguably, some of the most prolific arguments have been tabled with the ideas of the lower values of shares need not to be paying dividends. This is because only those who hold bulk shares are in any benefit from their investments. Equally, the major assumptions that materialize here are those of the retained earnings, the cost of capital and identified with the CAPM model and the brand life as endless (Da, Guo & Jagannathan, 2012). With the position that this assertion has as misleading, their main concern has equally been identified as one position from which the company and the corporate value of the brand can be accessed.

Therefore, with the literature review focusing on the assessment and the theories that are attached to the management and the functioning of the dividends theory, it will be true to assert that the identification and the assumption of the perpetual aspect for life for the company is one thing that corporate brand can use in enticing their investors. Such is made along the various directions of the dividend policies (Mitton, 2004). In essence, the dividend policies have been described as inclusive of the ideas that are attached to the management of the dividend policies in this dissertation presentation. Equally, looking at the suggestions that have been attached by the underlying issues on dividend policies, this literature review has assessed the position that is attached to dividend policies based on the need to have a gain and a positive description on the corporate value. In essence, the next chapter presents the methodology under which the analysis will be focusing on suggestions the collection of data and collection of information on dividend policies and corporate value (Bena & Li, 2014).

The methodology will primarily seek to further the analysis that has been presented by the literature review. This is practically based on the suggestions of the use of secondary research owing to the nature of the research objectives, the scope, and the research questions. Therefore, with the objective and the questions identified earlier in the introduction, the scope will be suggestive to cover the dividend policies in the four countries. This is, therefore, going to be the corporate analysis of the dividend policies as advanced with a number of companies in the United States, United Kingdom, Japan and China. In essence, these companies are the Tesco group of retail supermarkets in the United Kingdom, the McDonalds chain restaurants in the United States, the 21 Lady Company Limited in Japan and the China Construction Bank. The choices have been selected from seemingly different sectors of retail position except for the China Construction Bank as the McDonalds will be taken as representative of the performance of the public retailers in the Chinese economy.

Therefore, the management of this methodology will seek to develop an analysis on the position of the portfolio growths of the four companies as suggested by their annual reporting. This will equally be the position from which the growth in the cost of equity will be assessed, the growth in dividends will be assessed, and equally the position from which the value created with the paid dividend will be documented.

Other than the tabling of the performance of the companies and the subsequent payment of dividends, this methodology will seek to explore the use of the categorical data in the analysis. This is attached to the suggestions of the friendliness of dividend policies to investors’ confidence among companies and equally the environment that regulates the use and the formulation of the dividend policies.

In essence, this methodology will be more like a descriptive analysis solves the major concern raised by the research questions and the research objectives which are levelled with the identification of the differences and dividend policies among these developing and developed nations (Bryman, 2012).

With the interest that the methodology has fronted the performance of the analysis is documented based on the position that is held with the four countries. Equally, it is considerate of the four companies chosen as representatives to their interest on dividend policies and corporate management in these countries. Previous research similar to those used in the literature review took the analysis of the dividend policies in two criterions. First were the comparisons of published earnings and the dividend payouts on the reflection of company performance. This comparative measure on dividend policies was seen as a biased, this is based on the direct inference to relevance of using these policies. Second were the studies on the determinants of dividends from which Mitton (2004) argues on the function Du = rtEt, this is the target of firms which reflects the dividend policies and the target ration in the years compared to the actual profits and dividend received. Thus, this second approach is more interested in the reasons for making adjustments rather than focusing on the direct effects and needs of the dividend policies (Michaely & Roberts, 2012; Rees & Valentincic, 2013).

Developing from this angle, the following are the dividend policy analyses of the McDonalds restaurant, the Tesco supermarket, the 21 Lady Company Limited which is a retailer and the China Construction Bank. In this chapter, the interest will be functionally developed into the examination of the dividend policies that the companies have been having in the last two to three years. Thereafter the chapter will be presenting a discussion on a comparative measure of the dividend policies and the effects that have on the shareholder investment valuations, the growth of the capital equity that the companies have and equally the corporate value of the four brands (Wang, Manry & Wandler, 2011).

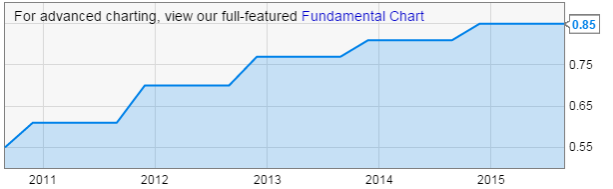

The description of the McDonalds provides some very concrete descriptions of the position that can be held by the American divide on the payment of dividends. In essence, the first time that the company was listed in the stock exchange market was in the year 1976 (Ycharts, 2014). It is impressive enough that the McDonalds also managed to pay its first dividends in the same year. More of this impressive record is that the company has been in the position of growing their dividend payments all along with their latest run from the year 2008 to 2014 recording the highest position of dividend growth on an annual base. In fact, they have been on the record of paying dividends at every quarter of operation with the latest being a $0.85 per share payable on the 16th of September 2015 (MCD, 2014).

In the attached figure, the growth of the dividends for the McDonalds brand can be evidently seen as valid to the earlier stated discussions. Equally, this information can be better classified with the presentation held by (Ycharts, 2014). With this in mind, it will now be important to analyse the annual report and to document the validity and the existence of the policies on the payments and the management of dividends. According to item 5 of the related shareholders matters the company has a very well structured dividend policy (MCD, 2014). With this, they provide information of the trading position of the company in the New York stock exchange as well a fully summary of the performance of their last financial year compared to the previous financial year. Thus, the dividend policy in the McDonalds Company seems like one that is positioned at the examination of the returns that the shareholders are givens based on the identification of the shareholder composition in terms of their numbers. This dividend policy equally states the record that the company has had in their 39-year history of payment. Arguably, Harris (2013) supports the position that is asserted with this move by the McDonalds Company. In essence, this supporting argument is based on the facts that the presentation of such information and with openness and clarity of information, it will be a position from which investor confidence is built from (Erkens, Hung & Matos, 2012). Nevertheless, it will also be important to note that the McDonalds financial reporting is based on the General Accepted Accounting Principles (GAAP) rather than the conventional International Financial Accounting Standards (IFRS) (Harris, 2013). With this, it is noted that the company is not compelled to the highlighting of the methodology from which the dividend payments are computed from. The simple presentation of dividend information is attached as the full and acceptable representation of the dividend policy that the companies in the United States will be having. On the other divide, it is noted from the annual report of MCD (2014) that the company has more than the shareholders’ investments in their equity composition. The position of material contracts is one that will be in need of further clarification to be considered as a dividend or a shareholding policy document. This brings the analysis to the assumptions that the developed nations and, in particular, the United States are seemingly not very open with their investment policies to their shareholders. Simple documentation based on the records of the financial performance of stock items cannot be assumed to be effective in swaying the opinion of shareholders, and corporate value on brand valuation as held by the IFRS 3 (Carmona & Trombetta, 2012; Ramanna, 2013).

The performance of the United Kingdom as an investment ground can be better established with an examination of their largest consumer markets. According to some of the data that is represented in Tesco Investor Policy (2006), the retail consumer market in the United Kingdom is equally the one that achieves such large magnitudes. The Tesco brand is, therefore, one of the major players in the United Kingdom’s retail consumer market. This is because of the dominance in the retail supermarkets and equally the position that they hold with their financial services pouring into the banking industry (Tesco Plc., 2014). Thus, looking at their divided history, the Tesco brand envelops the performance of the United Kingdom as one that is linked to the concerns of the IFRS. With this, the interest is that the company will need to keep a pathway in which they will be in a position to examine the payments of divided based on the laid guidelines. Looking at the Tesco Investor Policy (2006), in the year 2006, the Tesco brand is said to have been announcing a new dividend policy that is supposedly in existence up to now. This is in order to increase the dividend payouts broadly in line with its earnings growth rate (Tesco Plc., 2014). With this, the position that is described with the Tesco brand is one that would be appealing to the majority of shareholders and investment funds. Similar to the record that the American counterparty McDonalds is proud of, the Tesco brand has been in the last 20 year paying solid dividends based on their financial performance in these years. Looking at their performance as present in Tesco Plc. (2014), one will note that there are variations to the dividends that are paid all through the year quarterly results and, in particular, the overall year descriptions.

The description that is provided by the Tesco brand in their company profile equally suggests that the company is the one that asserts their performance and the moves with regards to the issues and the payments of dividends as matching to those of the regulators in the London stock exchange (Tesco Investor Policy, 2006). With this they have provided for their shareholders the option of the dividend reinvestment plan, fully payout or equally having them directly as savings for retirements. Exploring more on brand valuation, the performance of the Tesco brand in terms of their dividend payment and their dividend policy will be described as better behaviour with the affinity that is attached to the well being of the shareholders (Goldstein & Hackbarth, 2014).

In particular to the annual report of last financial years, the Tesco brand pays a full dividend of 14.76 p on which the group maintains that it has a good run with the return on capital documented at 12.1%. With this in mind, the notes to the financial statements equally describe the dividend policy that the company used in the year 2014. In Tesco Plc. (2014) the extract on the principal risks and the uncertainties describe the group strategy to investment and the group position in management and equally brings down the same emphasis on the company disclosure policy. Looking at these suggestions it will be true to consider that the United Kingdom representation has equally been seen as one company that has strived to disclose more on their performance and their use of the dividend policies. With this, this report assumes that to the interpretation of the IFRS in the United Kingdom, the simple description of policy statement will be enough for the interest sought after by dividend policies (Borker, 2012; Martins & Novaes, 2012). Nevertheless, the irregular pattern that seems with their description of dividend can equally be a position from which the effectiveness of their policy most precisely from 2006 can be examined and equally excused as functional.

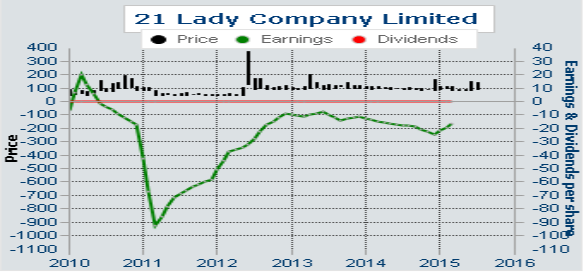

In nature, the attachment that is seen with the western side of dividend policy is very different to the interest that is served with the Japanese description on dividend payouts. The company operates a number of retail bakeries in the Japanese divide (21 Lady Company, 2015). Looking at their financial performance, a number of things are noted with the financial profitability of the company and the dividend payouts that are recorded from the year 2010 to 2014. The dividend payouts are flat withstanding the facts that the earnings of the company have been dropping. In fact, the dividend payouts during these four years have been described as zero per share as attached in the figure below (Gurufocus, 2014).

Figure 4 21 Lady return, dividend and price

With the Japan being one of the most liberally developed nations in the pacific region, their dividend policies seem to be tagged to the contents of the business and natural environments other than the financial performance. One would seemingly be expected the value of the share of the company to be dropped with the financial performance that the company may be posted in the financial years. As developed from the reporting that is staged with the 21 Lady Company, the direction of their dividend policies is attached as follow: the dividend payments of the company are based on the financial performance that it stages in the financial year. Nevertheless, they still maintain that the dividend payments will, however, be influenced also by a number of considerations. These are the environmental analyses that the company will be having in their industry and equally the dividend to equity ratio (21 Lady Company, 2015). In essence, the payments of dividend, therefore, appeal to the direction that is not very open to the shareholders in Japan. This is because even with a good financial performance, the gains that the shareholder might be making will materially be brought to a re-assessment and a re-evaluation based on the business environment and the dividend to equity ratio which this report assumes is to set the standard in the Japanese trading of equities.

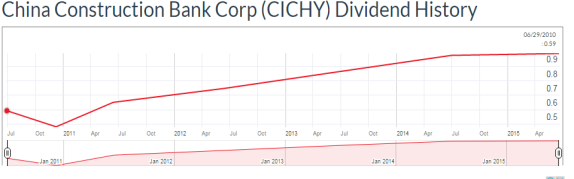

The Chinese Construction Bank is constituted of capital and equity composition, and it is one of the largest commercial banks among the Asian nations. In the mean time, it is one of the leading financial institutions in the Asian market (Chemmanur, Loutskina & Tian, 2014). Looking at their corporate profile, it is noted that the company treats its stakeholders very seriously. The dedication is the evidence from the investor profile that the company maintains. The China Construction Bank can seemingly be excused to be the best example of the four examining domains and it will be tabled in the discussion. This is materially based on the very good and considerable growth rates that the company has provided with their dividend growths in the last four financial years. The growths in dividends have been materially from the low point on the first half of the 2011 financial year to the almost flat position that the dividend growth attained at the beginning of the financial year 2015-2016, as attached to the figure below (CCB: Corporate Profile, 2015).

Figure 5 CCB dividend histories

Looking at this historical valuation, the position that is described now will need to fully analysis the management position to the payments of the dividends according to Short, Zhang and Keasey (2002). With a similar position to the description of free trade and disclosure of information, China seems to be on the upper hand even with the treatment of their operations with general regard for communism. Nevertheless, the position that is asserted with the overall performance of the company can be taken from their annual report (China Construction Bank, 2014). This is because rather than the normalcy that has been seen in summarizing the dividend policies, as well as skimpily providing for the methodology under which the dividends were valued. The performance of the company in managing ethics seems to be the only one that is fully catching up with the IFRS regulations on financial reporting. The profit and dividend chapter are provided such that the investor will be in a position to weigh for themselves the ratio and the percentage of profit that will be dedicated to the dividends.

Equally, the chapter has an extract on the formulation and the implementation of the cash dividend policy. With this, the China Construction Bank has their policy statement of “the bank shall distribute dividends in cash if its profits in the year are recorded and if it has a positive accumulation on undistributed profits” (China Construction Bank, 2014, p. 97). According to Gebhardt and Novotny-Farkas (2011), there are a number of positions that can be extracted for such a policy statement. With this, one will note that the China Construction Bank only pays the dividends in the case that it has recorded profits, equally the dividend payouts are only made in cash if the undistributed costs are positive. This implies that the company might be in a position to pay dividends by using other options such as share splits or bonus of the undistributed profits for the years when the profits are negative. In particular, the formulation and the implementation of cash dividend policy that the China Construction Bank has provided to go ahead to describe and quantify the undistributed profits of the company. This is described as the fact that the company will only be in the position to distribute the cash dividends if the undistributed profits are not less than 10% of the net profits.

One will seemingly note that the computation and the final declaration of dividends in the Chinese decryptions seen to be very much attached to the procedure. In majority of the state-controlled companies as suggested by Cheng, Ioannou & Serafeim (2014), the payments of dividends are equally affected by the shareholding capacity that the state will be having in these companies. Thus, the higher the state control and influence, the lower the dividend payouts. Hence, there is seemingly a negative association between the length of control chain and the dividends that are given by the Chinese companies (Martins & Novaes, 2012). With this in mind, it will equally be very impotent to assess the shareholder composition of the China Construction Bank. According to Borker (2012), this is described as a control that is at 9%, perhaps this is the reality with the positive position that the bank has been having with their undistributed profits over the years.

Looking at the interest that has been served by the descriptive analysis of the financial statement as presented in the annual report for the four companies, a difference is seemingly noted in the position that the regulatory framework has been used in financial reporting (Callao et al., 2011).

|

Company |

2010 |

2011 |

2012 |

2013 |

2014 |

|

MCD |

1.65 $ |

1.83 $ |

2.1 $ |

2.34 $ |

2.47 $ |

|

Tesco |

4.37 GBP |

14.64 GBP |

14.97 GBP |

14.97 GBP |

12.29 GBP |

|

CCB |

0.24 ¥ |

0.18 ¥ |

0.17 ¥ |

0.18 ¥ |

0.4 ¥ |

|

21 Lady |

0 |

0 |

0 |

0 |

0 |

Looking at the description of the most successful economy in the world, the McDonalds’ description of the United States seems very unattractive to the interest that the shareholders will be having. This is based on the lack of a formidable dividend policy as described in the regulation of the GAAP (Harris, 2013). On the other hand, the description that has been presented by the Tesco brand signals a very different and a more ample procedure into the declaration of dividends. The dividend policy stipulates the payments of dividends based on the position that the company will be having in their profits. It will be important to note that the United Kingdom seemingly attaches dividend payments to the position that is asserted with their profitability (Li & Zhao, 2008).

Moving this interpretation to the Asian side of the analysis, the two countries represented, in this case, are Japan and the People’s Republic of China. With these two nations, there has been some differences that have been noted are, in the maintenance of the investment and the formulation of dividend policies, it has been noted that the two countries are seemingly attached to policies, but the position of China is more detailed in terms of the IFRS satisfactions (Gebhardt & Novotny-Farkas, 2011). Thus, the development of the dividend policies in the China Construction Bank brings to light the reason why the company will be providing anything else to their shareholders other than the dividend payments in terms of cash payments. With this, this report is about the idea that the China has a better position because of the recognition of dividend policies. Equally fronting from the position that was developed earlier in the introduction, the choice of China is taken as one of the economies which is on the move and labelled as developing. Thus, in the developing nations, the stability that is sort after in the management of dividend policies seems to be better placed compared to economies which already have this as a fact (Badertscher, Katz & Rego, 2013). Thus, it is noted that the company has no regulations on the choice of dividend payment. Nevertheless, a look at Japan and China reveals that the Asian description of dividend policies is more attached to a number of bottlenecks. This brings to light the limitation of shareholders’ freedom which is practically attached to the United Kingdom valuation on shareholders and dividend policies. In essence, this is the position that the analysis will prefer an investment made in the United Kingdom compared to the economies of the United States, Japan and China. Individually, the United States falls out of the interest of this report based on the interest that the GAAP has some material differences in recommendations for financial reporting as provided by the 10-K annual report for the McDonalds Company (Harris, 2013).

In the second description of Japan, the 21 Lady Company Limited is noted to have a flat yield curve even with the situation where share value and revenue value were growing. This is based on the fact that the dividend payments are not materially based on the valuation of the company financial performance; however, dividend valuation is also provided for the interest of environmental factor in the course of the financial year. Lastly, even with China posting the best of disclosure of information, the interest of this report comes to the conclusion of fear. This is because the state has controlled the level and the payment of dividends. Equally, dividends been paid are not based on the net profits of the company, but on the profits to which the company calls undistributed profits. Another limitation is that the undistributed profits equally need to be figured at a 10% or more valuation for the shareholders to get any dividends. This dividend policy is tighter but clear in execution (Martins & Novaes, 2012).

Looking at the position that has been described with the four valuations of the descriptive analyses above, the methodology was seeking to highlight the research objectives on existence and reasons behind the differences in dividend policies. This has been satisfied, the research questions are answered as follows. The effects of dividend policies are mainly attached to the shareholders’ affinity to investments. This is material to the position that is described in the shareholders needing an assurance when it comes to dividend growth. In this sense, looking at the information held in the Ycharts (2014), the payment of dividends by the McDonalds Company seems static, and information to shareholders can very well interpret this as a direction that the company has the restricted position in dividend payments (Li & Zhao, 2008). This is to imply that the dividend payments are the grounds from which China and the United Kingdom seemingly want to maintain good investment relationships with their shareholders. Nevertheless, the assumption that is in this report will equally be guided by the government control in China. It is noted that this is affected based on the high debt levels that the state control has. This, therefore, implies that the state will be willing to hold profitabilities in order to offset their debts.

The development of this report was conclusively presented with the interest of assessing the dividend policies in the global markets. Thus, based on the outline that was presented in the introduction, this report served to fully follow the mandate based on the presented literature review. A description of the methodology was used and the presentation of the analysis was based on the descriptive data that the methodology presented. With this, the literature review sought to describe the dividend policies based on the underlying issues that are attached to the dividend policies in the different regions. It has been noted that the different geographical and economic regions have very different sets of operations in the maintenance of the dividend policies. This has been equally a position that was materially examined by using the development that was staged in the analysis segment of this report. In essence, the signalling effect, the decision-making direction and the profit sharing motive of dividend policies have equally been examined as suggested by the last sub-chapter of the literature review.

With this interest that has been developed equally in the descriptive data analyses, it has been noted with the special interest that there are no regulations from the global regulatory accounting standards. This is on the measures that can be used in declaring and the exercising of payments for dividends. This has been noted as a move that is coming from the deviation of the different policies in companies as implemented in Japan, the United Kingdom and the Republic of China, which all use the IFRS. With this position in mind, it is true to assert that the answers to the research questions are all position.

Therefore, for companies in China, the government can be the influencing factor in maintaining their interest on dividends policies. Equally, the position that the investors and the shareholders have in this case is very dormant. This is because the dividend policies that a company will use are only developed and determined by the company itself without and prior of the future consultations (Cheng, Ioannou & Serafeim, 2014). Thus, to have a better position in attracting shareholding capital, the dividend policies need to be structured in a way that they will signal shareholder value and attention. Equally, ample and steadfast decision making has been noted as effective on judgments as suggested using the client theory in the literature review. As a result, dividend policies are, therefore, asserted as a position from which influence in shareholder investment can be sought after (Li & Zhao, 2008).

21 Lady Company (2015) Annual report, dividends payout, accessed 21 July 2015, HYPERLINK "http://performance.morningstar.com/stock/performance-return.action?p=dividend_split_page&t=3346®ion=jpn&culture=en-US" http://performance.morningstar.com/stock/performance-return.action?p=dividend_split_page&t=3346®ion=jpn&culture=en-US

Aguinis, H. & Glavas, A. (2012) 'What we know and don’t know about corporate social responsibility a review and research agenda', Journal of management, vol 38, no. 4, pp. 932-940.

Badertscher, B.A., Katz, S.P. & Rego, S.O. (2013) ' The separation of ownership and control and corporate tax avoidance', Journal of Accounting and Economics, vol 56, no. 2, pp. 228-250.

Baird, L.L. (2014) Using research and theoretical models of graduate student progress, Jossey-Bass Publishers, San Fransisco.

Bena, J. & Li, K. (2014) 'Corporate innovations and mergers and acquisitions', The Journal of Finance, vol 69, no. 5, pp. 1923-1960.

Bloomberg (2015) Tesco Plc , accessed 03 July 2015, HYPERLINK "http://www.bloomberg.com/research/stocks/financials/financials.asp?ticker=TSCO:LN" http://www.bloomberg.com/research/stocks/financials/financials.asp?ticker=TSCO:LN

Borker, D.R. (2012) 'Accounting, culture, and emerging economies: IFRS in the BRIC countries', Accounting, culture, and emerging economies: IFRS in the BRIC countries, vol 10, no. 5, pp. 313-324.

Brammer, S., Jackson, G. & Matten, D. (2012) 'Corporate social responsibility and institutional theory: New perspectives on private governance', Socio-Economic Review, vol 10, no. 1, pp. 3-28.

Bryman, A. (2012) Social research methods, Oxford University press, London.

Callao, S., Ferrer, C., Jarne, J.I. & Lainez, J.A. (2011) 'The impact of IFRS on the European Union: Is it related to the accounting tradition of the countries', Journal of Applied Accounting Research, vol 10, no. 1, pp. 33-35.

Carmona, S. & Trombetta, M. (2012) 'On the global acceptance of IAS/IFRS accounting standards: The logic and implications of the principles-based system', Journal of Accounting and Public Policy, vol 27, no. 6, pp. 455-461.

CCB: Corporate Profile (2015) New Investor, accessed 21 July 2015, HYPERLINK "http://www.ccb.com/en/newinvestor/ddividend.html" http://www.ccb.com/en/newinvestor/ddividend.html

Chemmanur, T.J., Loutskina, E. & Tian, X. (2014) 'Corporate venture capital, value creation, and innovation', Review of Financial Studies, vol 27, no. 8, pp. 2434-2473.

Cheng, B., Ioannou, I. & Serafeim, G. (2014) 'Corporate social responsibility and access to finance', Strategic Management Journal, vol 35, no. 1, pp. 1-23.

China Construction Bank (2014) Annual report, accessed 21 July 2015, HYPERLINK "http://www.ccb.com/en/newinvestor/upload/20150429_1430311957/20150429203640060598.pdf" http://www.ccb.com/en/newinvestor/upload/20150429_1430311957/20150429203640060598.pdf

Da, Z., Guo, R.J. & Jagannathan, R. (2012) 'CAPM for estimating the cost of equity capital: Interpreting the empirical evidence', Journal of Financial Economics, vol 103, no. 1, pp. 204-220.

Erkens, D.H., Hung, M. & Matos, P. (2012) 'Corporate governance in the 2007–2008 financial crisis: Evidence from financial institutions worldwide', Journal of Corporate Finance, vol 18, no. 2, pp. 389-411.

Fatima, A.H. & Abdullah, A.M. (2014) ''Firms’ Financial And Corporate Governance Characteristics Association With Earning Management Practices: A Meta-Analysis Approach', Journal Of Economics And Business, vol 12, no. 2, pp. 49-74.

Gebhardt, G. & Novotny-Farkas, Z. (2011) ' Mandatory IFRS adoption and accounting quality of European banks', Journal of Business Finance & Accounting, vol 38, no. 3-4, pp. 289-333.

Goldstein, I. & Hackbarth, D. (2014) 'Corporate finance theory: Introduction to special issue', Journal of Corporate Finance, vol 29, no. 1, pp. 535-541.

Gurufocus (2014) 21 Lady Financials, accessed 21 July 2015, HYPERLINK "http://www.gurufocus.com/financials/NGO:3346" http://www.gurufocus.com/financials/NGO:3346

Harris, P.A.L.W. (2013) 'US GAAP Conversion To IFRS: A Case Study Of The Balance Sheet', Journal of Business Case Studies (JBCS), vol 9, no. 2, pp. 133-140.

John, V. (2015) Japan's “Show Me the Money” Corporate Governance - June 2015, accessed 13 July 2015, HYPERLINK "http://en.nikkoam.com/articles/2015/06/japans-show-me-the-money-corporate-governance-june-2015" http://en.nikkoam.com/articles/2015/06/japans-show-me-the-money-corporate-governance-june-2015

Li, K. & Zhao, X. (2008) 'Asymmetric Information and Dividend Policy', Financial Management, vol 37, no. 4, pp. 673-694.

Martins, T.C. & Novaes, W. (2012) 'Mandatory dividend rules: Do they make it harder for firms to invest?', Journal of Corporate Finance, vol 18, no. 4, pp. 953-967.

MCD (2014) Investor Stock, accessed 21 July 2015, http://www.aboutMcDonalds.com/mcd/investors/stock_information/dividends.html

Michaely, R. & Roberts, M.R. (2012) 'Corporate dividend policies: Lessons from private firms. Review of Financial Studies', Review of Financial Studies, vol 25, no. 3, pp. 711-746.

Mitton, T. (2004) 'Corporate governance and dividend policy in merging markets', Emerging Markets Review, vol 5, no. 4, pp. 409-426.

Ramanna, K. (2013) 'A framework for research on corporate accountability reporting', Accounting Horizons, vol 27, no. 2, pp. 409-432.

Rees, W. & Valentincic, A. (2013) 'Dividend irrelevance and accounting models of value', Journal of Business Finance & Accounting, vol 40, no. 5-6, pp. 646-672.

Roberts, M.R. & Whited, T.M. (2012) 'Endogeneity in empirical corporate finance', SSRN, vol 1, no. 1, pp. 1-9.

Short, H., Zhang, H. & Keasey, K. (2002) 'The link between dividend policy and institutional ownership', Journal of Corporate Finance, vol 8, no. 2, pp. 105-122.

Strebulaev, I.A. & Whited, T.M. (2013) 'Dynamic corporate finance is useful: A comment on Welch', SSRN, vol 2, no. 4, pp. 12-29.

Taylor, G. & Richardson, G. (2012) 'International corporate tax avoidance practices: evidence from Australian firms', The International Journal of Accounting, vol 47, no. 4, pp. 469-496.

Tesco Investor Policy (2006) Announcement of new dividend policy, accessed 21 July 2015, HYPERLINK "http://www.early-retirement-investor.com/-announcement-of-new-dividend-policy-.html" http://www.early-retirement-investor.com/-announcement-of-new-dividend-policy-.html

Tesco Plc. (2014) Shareholders, accessed 03 July 2015, HYPERLINK "http://www.tescoplc.com/index.asp?pageid=43" http://www.tescoplc.com/index.asp?pageid=43

Wang, X., Manry, D. & Wandler, S. (2011) 'Stock Dividend Policy in China', Journal of Global Business Management, vol 7, no. 2, p. 1.

Ycharts (2014) MCD Dividends, accessed 21 July 2015, HYPERLINK "http://ycharts.com/companies/MCD/dividend" http://ycharts.com/companies/MCD/dividend

24h在線客服

24h在線客服

備案號(hào):遼ICP備19007957號(hào)-1

![]() 聆聽您的聲音:feedback@highmark.com.cn企業(yè)熱線:400-778-8318

聆聽您的聲音:feedback@highmark.com.cn企業(yè)熱線:400-778-8318

Copyright ?2015- 海馬課堂網(wǎng)絡(luò)科技(大連)有限公司辦公地址:遼寧省大連市高新技術(shù)產(chǎn)業(yè)園區(qū)火炬路32A號(hào)創(chuàng)業(yè)大廈A座18層1801室

499元

一節(jié)課

咨詢電話

咨詢電話:

186-0428-2029

在線咨詢

微信客服

微信咨詢

回到頂部

hmkt088

欧美精品一区二区三区a片| 久久精品三区| 国产成人无码精品久久二区三| 99国精产品自偷自偷综合| 亚洲一区二区无码在线观看| 香蕉人妻AV久久久久天天| 欧美天天爽| 免费行情网站app入口| 91精品国产手机| JUX916人妻中出し深夜| 国产人妻人伦精品一区二区| 内射视频网站| 欧美性生交XXXXX无码小说| 日韩毛片无码永久免费看| 免费观看黄色录像| 大伊香蕉精品视频在线| 国产成人综合欧美精品久久| 亚州精品无码人妻久久99| 日本在线一区二区三区| 人妻丰满精品一区二区A片| 欧美国产操逼| 免费观看亚洲AV| 日本精品人妻无码77777| 亚洲无码另类| 99精品偷自拍| 亚洲天堂成人网| 久久精品国产精品成人片| 日韩一区三区| 日韩精品久久无码一区二区| 久久露脸国语精品国产91| 欧美成人18| 本道综合精品| 免费看欧美成人A片无码| 夜夜操av| 天堂а在线中文在线新版| 另类少妇人与禽zOZZ0性伦| 日韩欧美亚洲综合| 蜜桃一区二区三区| 人妻av中文| 欧美韩国日本| 亚洲第一a| 成人无码片黄网站A毛片免费| 无码国内精品人妻少妇蜜桃视频| 日本熟妇六十路 五十路| 久久久午夜| 五十路大垂乳熟妇| 孕妇AV在线| 狠狠大香蕉| 国产伦亲子伦亲子视频观看| 久久无码专区| 国产欧美日韩一区| 色五月激情五月| 欧美日韩电影一区二区| 亚洲欧洲精品视频| 亚洲AV无码乱码国产精品| 日韩无码xxx| 女同做爱视频| 一级欧美日韩| 国外亚洲成AV人片在线观看| 五月丁香综合激情| 深夜精品| 视频一二区| 九九精品99久久久| 国模私拍一区二区三区| 日日做A爰片久久毛片A片英语| 成人深夜视频| 午夜成人免费电影| 人妻影院| 真实的国产乱XXXX在线| 无码精品人妻一区二区湖北九色| 国产免费黄色片| 日本熟妇无码| 国产精品性爱| 婷婷四色| 欧美大片| 日韩午夜理论| 天天精品视频| 国产69精品一区二区亚洲孕妇| 亚洲性爱视频| 人人澡人人射| 青青草视频免费观看| 成人午夜网站| 欧美精品第一页| 国产午夜成人AV在线播放| 能免费看18视频网站| 日韩中文字幕综合| 亚洲乱码日产精品BD| 日本黄色日逼视频| 国产国语亲子伦亲子| 天堂www中文最在线官| 美女张开腿让男人| 激情内射人妻1区2区3区| 色7成人网站AV在线观看| 综合色婷婷| 亚洲欧洲中文日韩久久AV乱码| 亚洲资源AV| 综合网久久| 欧美综合在线观看| 午夜不卡久久精品无码免费 | 免费观看亚洲AV| 精品一区二区三区久久| 久久一区二| 久久精品国产成人AV| www.黄视频| 国产精品1234| 国产AV人人夜夜澡人人爽麻豆| 无码久久久久久久| 丰满少妇被猛烈高清播放| 人妻少妇的欲望| 日韩视频在线观看| 章泽天在伦敦音乐节被偶遇| 日韩美女一区二区三区| 尹人综合网| av天堂最新| 欧美性生交XXXXX无码小说| 国模videos私拍1080P| 香蕉人在线香蕉人在线 | 日本极品少妇| 亚洲人妻内射| 午夜影院试看五分钟| 91人妻中文字幕在线精品| 伊人中文网| 国产亚洲精品AAAAAAA片| 日本久久免费| 国产精品久久av| 这里只有精品6| 欧美性爱综合网| 亚洲不卡视频| 久久精品国产AV| 国产成人精品一区二区| 欧洲av在线| 日韩天堂| 免费无码毛片一区二区A片| 免费在线观看黄片| 影音资源av| 精品成人免费视频| 一本之道久久| 日韩无码视频网址| 亚洲无码高清不卡| 日韩精品欧美精品| 一区二区中文| 日日操夜夜| 婷婷色中文网| 久久无码国产精品| 人妻超碰| 亚洲人成中文字幕在线观看| 久久久久久久9| 国产精品无码一区二区三区太 | 亚洲天堂久久| 精品人妻伦一二三区久久春菊| 久久毛片视频| www超碰| 欧美色图日韩| 国产精品99无码一区二区| 国产精品无码成人久久久| 久久香蕉国产| 丝袜 激情 国产 制服 另类| 亚洲毛片一区| 亚洲第一视频在线观看| 欧美性爱一区二区三区| 亚洲精品乱码久久久久久蜜桃91| 亚洲国产成人精品女人久久久| 亚洲熟女一区| 97精品人人A片免费看| 国产乱子轮XXX农村| 精品夜夜澡人妻无码AV| 国产精品手机在线观看| 亚洲色中文字幕| 亚洲Av无码乱码在线观看| 亚洲а∨天堂久久精品2021| 欧美国产精品| 四虎成人精品在永久在线无码观看| 国产3p露脸普通话对白| 少妇AV片| 亚洲电影第1页| 亚洲综合视频| 亚洲A片成人无码久久精品青桔| 亚洲自拍偷拍视频| 免费无码人妻a8198v网站| 日本欧美精品91成人久久久| 欧美性高潮| 欧美亚洲激情| 欧美老少妇| 性受xxxx黑人xyx性爽| 理论片午夜| 日本少妇毛茸茸高潮| 欧美7777| 欧美日本免费一道免费视频| 亚洲 欧美 中文字幕| 蜜臀av.com| 亚洲AV无码一区二区少妇| 亚洲国产精品SUV| 日韩大片ppt免费ppt| 无码人妻一区二区三区一| 精品少妇久久久久久888优播| 国产精品久久久久影院色老大| 久久精品99国产精品日本| 日韩18禁| 国产精品黄色| av黄色在线免费观看| 51国产偷自视频区视频| 大伊香蕉精品视频在线| 亚洲精品永久www.5273.| 三级无码在线播放| 国产精品99精品| 丁香五月在线| 啪啪综合网| 欧美男女性爱视频| 色鬼网站| 91色国产| 一本一道久久久a久久久精品91| 精品影院| 国产夫妻在线视频| 日韩欧美无| 欧美精品123| 婷婷丁香五月婷婷| 激情又色又爽又黄的A片| 青青草免费公开视频| 国产精品亚洲αv天堂无码| 色色无码视频| 欧美叉叉叉BBB网站| 欧美最猛黑人xxxx| 人妻体体内射精一区二区| 亚洲午夜精品一区二区三区| 操日本老熟女| 日韩一区二区视频| 一本大道综合伊人精品热热| 国产久久久久久| 熟女超碰| 亚洲AV丰满熟妇在线播放| 色吧综合| 三十熟女| 久久AV无码| 国产不卡无码| 日韩深夜视频| 欧美影院| 久久久久无码| 成全视频在线观看免费高清| 国产精品一区二区久久| 国产精品无码久久aⅴ嫩| 中文成人在线| 欧美色图综合网| 女同一区二区| 男人天堂视频网站| 精品2区| 91天天综合| 天天射天天操天天干| 国产一级无码毛片| 九色91蝌蚪| 色综合久久中文字幕无码| 欧美成人精品A片免费一区99| 国产无码a| 狼友视频在线观看| 午夜久| xxxx色| 色欲久久久天天天综合网| 欧美一区二区三区色| 蜜桃在线一区二区| 国产va免费精品观看精品| 韩日黄色片| 午夜久久久久| 久久久久久久久久一级| 老司机亚洲精品| 99在线播放| 色男人天堂| 精品国产综合| 中文字幕人成人乱码亚洲电影| 九九国产| 欧美二区在线观看| 99人妻碰碰碰久久久久禁片| 九九热精品| 亚洲欧美www| 亚洲熟妇女| 夜夜操夜夜| 狠狠躁日日躁夜夜躁av| 四虎一区二区| 密臂av性久久久久蜜臂av| 免费无码毛片一区二区A片 | AV小说在线观看| 国产精品久久久日日碰碰| 熟妇人妻中文字幕无码老熟妇| 高潮喷水在线| 狠狠爱av| 国产又黄又粗的视频| 伊人网视频| 婷婷开心五月| 欧美一区,二区| 久久wwww| 欧美激情第1页| 日韩午夜精品| 少妇被大黑捧猛烈进| 人妻精品视频| 日本一本二本三区免费| 校花娇喘呻吟校长陈若雪视频| 亚洲欧洲中文日韩久久AV乱码| 一区二区三区黄片| av亚洲产国偷v产偷v自拍麻豆| 超碰v| 免费毛片视频| 高清无码色| 无码人妻精品一区二区中文| 亚洲日本成人| 人妻无码久久| 国产精品成人AV在线观看春天| 国产精品毛片无码| 99精品偷自拍| 色婷婷av一区二区三区| av手机在线免费观看| 国产精品美女久久久久久| 麻豆影视av| 影音先锋女人AA鲁色资源| 山西订婚强奸案入选最高法案例| 中文字幕精品无码一区二区| 狠狠操免费视频| 日韩福利导航| 国产精品宾馆| 伊人久久网站| 88影院| 国产日韩综合| 日韩av不卡一区| 国产日韩一区二区三免费高清| 动漫涩涩免费网站在线看| 日韩少妇| 国产国产乱老熟女视频网站97| 色悠悠久久| 国模小黎自慰GOGO人体| 国产成人精品999在线观看| 少妇高潮呻吟A片免费看软件| 99伊人| 熟妇在线播放| 亚洲第一a| 99精品免费| 久久精品国产精品成人片| 国产精品综合网| 国产91成人欧美精品另类动态| 天堂成人视频| 在线播放无码后入内射少妇| 亚洲熟妇无码另类久久久| 精品九九视频| 91视频精品| 日本人妻丰满熟妇| 欧美美女视频| 国产精品欧美性爱| 九色精品视频| 精品人妻伦一二三区免费| 国产日韩中文字幕| j插b| 激情内射人妻1区2区3区| a级片网站| 久久51| 国产一级内射| 天堂欧美| 怡红院AV亚洲一区二区三区H| www.四虎在线观看| 成人无码精品1区2区3区免费看 | 国产一区二区三区在线视频| 无码人妻精品 精品一区二区三区| 综合色在线| 亚欧无码人妻XXXX| 情欲禁地| 久久人妻| 亚洲综合少妇| 久久青青操| 在线内射| 五月网站| 丁香伊人网| 日韩午夜爽爽人体A片视频| 九九久久伊人| 青青草免费公开视频| 精品国产亚洲AV麻豆| 欧美性猛交AAAA片黑人 | 亚洲成人AV片| 欧美又大粗又爽又黄大片视频| 欧美激情一区二区| 影音资源av| 中文字幕日韩人妻| 久久人人妻性色av| 一二三区免费视频| 国产精品1区| 少妇大叫太大太粗太爽了A片 | 伊人婷婷综合| 日韩影院在线观看| 无码少妇高潮喷水A片免费| AV无码一区二区三区| 精品一二三区久久AAA片| 污污内射久久一区二区欧美日韩| 臭小子姨妈腰快断了第12集| 伊人久久超碰网| 亚洲精品白浆高清久久久久久| 国产午夜无码视频在线观看| 超碰人人射| 香蕉大视频一二三区乱码| 夜夜爽77777妓女免费下载| 内射视频网站| 午夜精品久久久| 亚洲 小说区 图片区| 中字幕人妻一区二区三区| 精品国产99久久久久久宅男i| 八戒青柠影视剧在线观看| 免费无码毛片一区二区APP| 99热香蕉| 日本欧美一区| 精品一二三区久久AAA片| 色小说综合| 国产精品无码久久久久成人影院| 午夜在线| 亚洲乱码日产精品BD| 97色婷婷| 亚洲一级内射| 99亚洲国产精品| 91精品无码| 国产精品无码一区二区三区免费| 国产最新视频| 久久精品国产AV| 97国产一区| 亚洲黑人在线| 西西4444WWW无码精品| 久久精品一区二区三| 激情五月综合网| 亚洲精品小电影| 夜夜操av| 不卡的aV| 精品一区二区三区在线成人| 日屁视频| 欧美肉大捧一进一出免费视频 | 98国产精品综合一区二区三区| 成人AV在线播放| 国产肥白大熟妇BBBB视频| 欧美色综合天天久久综合精品| 曰本无码人妻丰满熟妇啪啪| 久久久久国产熟女精品| 国产免费黄色| 久久性爱视频| 国产在线成人| 国产三级视频在线播放| 一本一道久久a久久精品蜜桃 | 精品视频久久| AV亚洲在线| 人人爽人人草| 狠狠精品干练久久久无码中文字幕| 国产香蕉一区二区三区| 日本久久一区| 热久久久| 亚洲天堂社区| 免费+国产+无码| 9国产精品| 熟女视频一区| 午夜高清福利| 先锋影音AV资源站| 疯狂做受XXXX高潮A片| 韩日黄色片| 色亚洲欧美| 国产毛片精品一区二区色欲黄A片| AV大片免费观看| 中文字幕人妻丰满熟妇| 精品人妻一区二区三区久久夜夜嗨| 九色影院| 欧美顶级少妇做爰HD| 中文字幕首页| 欧美熟妇老熟妇8888久久久| 蜜臀一区二区| 粉嫩AV久久一区二区三区| 亚洲av无码在线免费观看| 国产视频综合| 国产偷人妻精品一区k八理伦电影| 色综合中文网| 色欲av久久av蜜臀av酒店| 亚洲成人一区在线观看| 天堂成人视频| 荡女精品导航| 久久九九视频| 欧美麻豆| A片试看50分钟做受视频| 无码丰满人妻| 夜夜操夜夜| 人妻少妇av中文字幕乱码牛牛| 国产精品丰满熟妇猛性bbw| 欧美日韩三级| 性爱视频日韩| 人妻熟女一区二区AV| 久久久夜| av在线观看网站免费入口| 欧美人妻中文字幕| 久久久精品无码人妻中文字幕| 亚洲精品一区二区口爆| 熟女超碰| 国产按摩AV| 亚洲国产av网站| 青草视频在线播放| 日韩一区三区| 精品少妇久久久久久888优播| 午夜激情影视| 中国丰满熟女A片免费观| 欧美一区二区三区精品| 天天插日日干| 香蕉视频你懂的| 激情五月综合网| 日韩无码高清一区二区三区| av一本在线| 国产成人精品一区二三区熟女在线| 久久大香蕉| 日韩高清一二三区| 蜜桃av久久久亚洲精品| 中文字幕在线播放视频| AA片在线观看视频在线播放| 亚洲综合网站| 欧美人与禽猛交乱配| 在线看黄色av| 久久久欧洲| 呦呦无码| 青青河边草免费观看影视大全| 人人妻人人搞| 四虎影| 亚洲av成人网| 91黄色片| 91精品国产麻豆国产自产在线| 精品无码在线| 国产精品无码一区| 日韩一级片| 国产精品久久久久久久久久新婚| 亚洲欧美熟妇| 91大香蕉| 你懂得在线| 无码馆| 天堂在线bt| 欧美一二三区| 欧美疯狂做受bbbbbb| 精品久久一区| 亚洲综合久久网| 亚洲综合第一页| 91午夜夜伦鲁鲁片无码影视| 影音先锋女人AA鲁色资源| 国产成人精品一区二三区熟女在线 | 亚洲狠狠婷婷综合久久久久图片| 国产精品综合网| 久久成人免费视频| 国产超碰人人模人人爽人人添 | 国产成人精品无码一区二区男按摩| 琪琪影院| 韩国真做片在线观看| 熟女人妻一区二区三区免费看| 欧美丰满熟妇BBB久久久| 欧洲第一无人区观看| 日本乱子人伦在线视频| 天堂资源AV| jlzzjlzzjlzz亚洲女| 日韩综合网站| 又粗又大又硬毛片免费看| 日韩AV在线免费观看| 亚洲精品色午夜无码专区日韩| 性按摩玩人妻HD中文字幕| 国产A√精品区二区三区四区| 超pen个人视频97| 熟妇天堂| 狠狠干2019| 3d黄动漫免费看| 欧美一级a| jizz中文字幕| 日韩精品一二三区| 日本久久综合| 操逼视频网页| 亚洲欧美精品久久| www.色网站| 国产特黄片| 伊人精品在线| 水蜜桃蜜桃在线观看| 亚洲视频三区| 天堂精品在线| 国产午夜成人AV在线播放| 国产精品又大又爽| 午夜一区二区三区| 成人精品视频99在线观看免费| 国内AV无码| 草草影院国产| 色哟哟一区二区| 91精品国产综合久久香蕉922| 国产精品无码一区二区三区太| 激情又色又爽又黄的A片| av免费播放| 一本一道久久久a久久久精品91| 精品亚洲国产成人A片在线鸭王 | 日韩性爱一区| 狼友AV在线| 少妇高潮毛片色欲AVA片| AA片在线观看视频在线播放| 亚洲中文字幕无码爆乳av| www.中文字幕| 亚洲av网站大全| 亚洲一区电影| 国产片一区二区| 无码精品人妻一区二区 | 色欲午夜无码久久久久久张津瑜 | 四虎在线永久| 亚洲无AV在线中文字幕 | 国产精品久久99精品国产| 国产伦精品一区二区三区| 久久成年人| 99热香蕉| 色悠悠视频在线观看| 97在线观视频免费观看| 亚洲无码1234| 日韩少妇精品| 少妇高潮呻吟A片免费看软件| 国产一区二区网站| 国产欧美一区二区三区精品酒店| 97AV超碰| 欧美久久一区二区| 午夜亚洲福利| 久久六月天| 欧洲亚洲综合| 日本精品视频一区二区| 少妇做爰免费视看片| 日韩亚洲欧美一区二区| 亚洲VA中文字幕无码| 成人综合网站| 日韩香蕉网| 国产午夜无码视频在线观看 | 制服.丝袜.亚洲.中文.综合| 97超碰人人| 日韩无码电影网| 新搬来的白领女邻居| 人妻内射一区二区在线视频| 激情视频激情图片激情小说| 久精品视频| 午夜在线视频| 三级国产av| 欧美不卡在线观看| 久久久久亚洲AV无码专区喷水| 熟妇人妻丰满久久久久久久无码| 国产在线观看黄片| 亚州综合视频| 亚洲情综合五月天| 色综合99久久久无码国产精品| 国产偷拍| 波多野结衣毛片| 精品色综合| 国产欧美一区二区精品久久久| 午夜福利一区| 大香蕉三级片| 疯狂做受XXXX高潮A片动画| 最近日韩中文字幕| 97色吧| 五月婷婷六月丁香| 色噜噜在线| 午夜精品福利在线| 四虎在线免费视频| 久久中文视频| 中字幕视频在线永久在线观看免费| 91九色网站| 亚洲人成中文字幕在线观看| 久久久久三级片| www.6969成人片亚洲| 婷婷午夜| 国产精品美女一区二区三区| 欧美久久一区| 午夜不卡久久精品无码免费 | 亚洲av人人澡人人人夜| 2020国产在线| 欧美1区2区3区4区| 国产日韩欧美成人| 亚洲亚洲人成综合网络 | 久久精品女人天堂av免费观看| 黑人糟蹋人妻HD中文字幕| 美女自慰影院| 黄色在线无码| 日本最新中文字幕| 免费黄色三级片在线观看| 成人欧美一区二区三区在线观看| 熟女人妻一区二区三区免费看| 无码在线电影| 777米奇影视第四色| 日本不卡一区二区三区| 在线中文字幕一区| 久久国产电影| 亚洲中文字幕人妻| 亚洲乱小说| 精品人妻在线| 中文三区| 91一区| 国产+高潮+白浆+无码| 国产免费高清| 日本久久久久久久久| 超碰人人射| 国产无码一二区| 一区二区三区视频在线播放| 日本猛少妇色XXXXX猛叫| 色色激情五月| 欧美 日韩 中文| 婷婷激情亚洲| 成人av在线网址| 在线网址你懂的| 精品国产乱码久久久久久1区2区| 国产精品亚洲天堂| 日韩乱伦免费视频| 国产人人干| 97人人模人人爽人人少妇| 午夜在线小电影| 美日韩av| 亚洲精品久久久无码| 蜜桃久久精品| 日韩人妻高清| 亚州男人天堂| 人人擦| 婷婷久草| 国产熟女网站| 神马影院在线| 国产毛片精品一区二区色欲黄A片| 欧美色图亚洲综合| JUX916人妻中出し深夜| 中文字幕在线国产| 成全视频在线观看免费高清| 久久久精品动漫| 欧美精品1| 国产精品久久久一区| 91av在线播放| 欧美人成视频在线观看| 少妇太爽了在线观看| 狠狠操夜夜干| 亚洲欧洲在线视频| 日韩欧美二区| 91无码视频在线观看| 成熟女人毛片WWW免费版在线| 在线伊人| 女人高潮内射99精品| 日韩一级黄片| 亚洲欧美在线观看| 欧美人成视频在线观看| 久久久久亚洲AV无码专区首护士| 成熟人妻av无码专区| 国精产品一区一区三区免费视频| 国产精品无码AV| 99久国产| 道日本一本草久| 丰满人妻老熟妇伦人精品| 一本久久道| 影音先锋男人站| 成人Av在线看| 成人伊人| 日韩a级片| 97成人网站| 后入大屁股视频| 成人精品视频99在线观看免费| 欧美国产日韩在线| 黄片av在线观看| freehd人妻少妇xxxx| 国产精品福利一区| 久久久久| 日本最新中文字幕| 超碰人人超| 久久国产成人精品国产成人亚洲| 日本欧美久久久久免费播放网| 国产精品国产精品| 亚洲国产综合一区| 777影院| 四虎永久在线| 老子影院| 亚洲成人视频在线观看| 亚洲AV综合一区二区| www无码视频| 免费一区二区| 精品无码一区二区三区aⅴ| 国产精品18久久久| 亚洲一级黄色片| 日韩精品免费一区二区三区| 欧美疯狂性受XXXXX喷水影院| 欧美久久久久久久久| 亚洲va欧美va国产va黑人| 久久久精品免费| 毛色毛片| 国产精品涩涩涩视频网站| 无码AV久久久久久久久| 九色国产| 精品人妻在线| 人妻丰满熟妇av无码久久奶水| 五月网站| 97视频| 高清无码久久| 青青草视频免费观看| www.欧美日韩| 亚洲AV无码专区国产| 99美女高潮喷水白浆| 高潮影院在线观看| 91精品国产麻豆国产自产在线| 国产精品久久久久无码软奇奇奇| 日日日天天日| 中文字幕在线视频免费观看 | 亚洲色综网| 丁香六月欧美| 亚洲人妻电影| 亚洲无码电| 黑丝无码在线| 亚洲天堂色| 97在线观视频免费观看| 国产FREESEXVIDEOS性中国| 99热久久这里只有精品| 青青河边草免费观看影视大全| 久久久无码精品国产| 熟女天堂| 无码aⅴ精品欧美一区二区三区| 国产精品-区区久久久狼| 尤物一区二区| 五月激情丁香婷婷| 色老大网站| 靠逼视频| 亚洲图片小说区| 欧美熟色妇| 国产一区二区美女| 亚洲 欧美 日韩系列| 网站一级片| 日韩精品免费一区二区在线观看| 亚洲一区二区人妻| 欧美黄色精品| 另类精品| 99国产精品白浆在线观看免费| 中文字幕无码人妻少妇免费视频 | 成人久久一区| 亚洲无码1区| 免费看欧美成人A片无码| 国产日韩欧美自拍| 色成人免费网站| 成人做爰A片免费看视频| 亚洲精品国产熟女久久久| 婷婷综合色| 欧美做受高潮| 九九久久99| 日韩无码高清一区二区三区| 久久中文一区| 午夜88| 99久久综合国产精品二区| 色天天| 欧美日韩国产片| 男人久久久| 日韩精品欧美精品| 超碰在线中文字幕| 国产一区二区三区四区五区加勒比| 日韩成人午夜视频| 亚洲精品白浆高清久久久久久| 国产真实乱人偷精品视频| 亚洲九九精品| 大香蕉777| 欧美成人一区二区三区在线视频| 无码免费日韩| 国产欧美综合一区二区三区| 欧美成人一区二区| 香蕉久久网| 久久成年人| 亚洲精品久久久久久久蜜桃| 人妻丰满熟妇无码区免费| 在线久草| 日韩a区| 欧美在线中文字幕| 蜜桃视频久久| 色噜噜噜噜| 日韩专区在线| 91久久久久久久久久久久| 国产一区二区三区欧美| 另类少妇人与禽zOZZ0性伦| 人妻狠狠干| 欧美福利一区| 精品一区无码| 免费无码毛片一区二区A片| 天天摸天天干天天操| 人妻久久一区二区| 国产日韩欧美成人| 欧美日本中文字幕| 一区二区精品久久| 成人无码精品1区2区3区免费看| 夜夜大香蕉| 青青久在线视频免费观看| 日韩人妻无码一区二区三区中文| 婷婷视频在线| 91精品综合久久久久久| 欧美性综合| jzzjzzjzz亚洲熟女少妇| www.国产色| 久久一本| 人人妻人人要| 91亚洲在线| 国产精品久久久久久免费播放| 毛片免费视频无码播放| 少妇人妻偷人精品无码视频新浪| 欧美日韩国产区| 男人j插女人p| 中文字幕人妻一区二区三级一区| 激情中文网| 少妇伦子伦精品无吗| 日韩电影二区| 国产精品久久久久久久久久直播| 极品人妻VIDEOSSS人妻| 四虎视频| 国产精品久久久久久久久久久久冷| 国产精品人成A片一区二区| mm131美女图片尤物写真丝袜| 免费视频黄片| 久草热8精品视频在线观看| 日韩精品毛片| 国产精品无码无套在线| 亚洲熟妇无码八av| 色婷婷丁香A片区毛片区女人区| 日本久久久久久久久| 日韩视频无码| 亚洲无码久久久久久久| 99精品国产在热久久| 九九热精品视频| 伊人亚洲| www色综合| 毛片久久久| 久久大胆人体| 草莓香蕉视频| 亚洲乱码日产精品BD| 欧美日本国产| 色亚洲一区| 精品日韩人妻| 欧美日韩一区三区| 亚洲欧美另类国产| 91在线导航| 香蕉视频黄色片| 少妇高潮无遮挡毛片免费播放| 色哟哟一区二区| 疯狂做受XXXX高潮A片| 欧洲色区| 99国产精品久久久久久久久久久| 激情久久久| 内射久久| 欧美在线观看视频| 国产欧洲亚洲| 成人伊人| 国产毛多水多女人A片| 中文字幕欧美一区| 成人女同av在线观看| 亚洲综合图色| 黑人巨大精品欧美一区二区免费| 人妻精品在线| 国产欧美一区二区白浆黑人| 国产色在线| 日本高清视频www夜色资源| 五月激情开心网| 亚洲香蕉视频| 成人国产欧美大片一区| 日本熟妇乱妇熟色A片蜜桃| 国产伦亲子伦亲子视频观看| 亚洲精品一区中文字幕乱码| 久久久99精品免费观看| www.亚洲国产| 国产毛片一区二区| 99久久精品免费| 在线观看视频你懂的| 日本狠狠干| 国产伦精品一区二区三区| 久久综合五月天| 国产一区二区三区在线| 亚洲愉拍99热成人精品| 亚洲三级色| 色伊人网| 亚洲AV日韩精品| 色接久久| 99在线精品免费视频| 91AVse| 色妞WW精品视频7777| 国模无码一区| 精品国产999久久久免费| 风流少妇A片一区二区蜜桃| 久久草视频| 日韩精品视频一区二区三区| 亚洲一级二级| 少妇高潮呻吟A片免费看软件| 丁香激情五月天| 国产亚洲精品久久久久2029| 欧美h视频| 激情五月亚洲| 人人爽人人爽人人| 欧美黄片在线| jzzijzzij日本成熟少妇| 免费观看欧美成人AA片爱我多深| 国产白嫩美女无套久久| 精品人妻少妇嫩草AV无码| 国产日韩一区二区| 天天碰天天摸| 国产婷婷在线观看| 国产综合精品一区二区三区| 九九热精品视频在线观看| 色爱综合区| 亚洲免费在线观看视频| 国产视频在线一区| 久久久久无码精品| 精品香蕉99久久久久网站| 欧美极品少妇| 欧美色综合色| 国模吧一区二区三区| www色综合| 亚洲精品国产熟女久久久| 人妻无码中文字幕| 91九色在线| 久久精品国产精品亚洲毛片| 51国产偷自视频区视频| 国产精品久久久无码| 成人三级片在线观看| 欧美性爱一区二区三区| 国产看真人毛片爱做A片| 欧美3区| 99re在线播放| 青青青操| 日本精品久久久久久| 久久久国产精品人人片| 噼里啪啦在线观看免费完整版视频| 一区二区欧美日韩| 色噜噜狠狠一区二区三区果冻| 亚洲AV网址在线| 夜夜高潮夜夜爽国产伦精品| 亚洲人妻性爱| 亚洲第一成人无码A片| 丁香色欲久久久久久综合网| 色噜噜狠狠色综无码久久合欧美| 一本无码高清| 蜜桃视频一区| 91天堂在线| 亚洲一区二区三区四| 亚洲成人网站在线播放| 超碰福利在线| 亚洲无码三级视频| 久久国产精品无码网站| 午夜福利182| 99国产精品久久久久久久久久久| 噜噜噜亚洲色成人网站| 香蕉久久久久| 亚洲国产精品VA在线看黑人| 精品亚洲一区二区三区| 国产美女永久免费无遮挡| 国产精品久久久久久久| 日韩免费视频| 欧洲激情| 久久六月天| 亚洲一级av无码毛片精品| 蜜桃传媒av免费麻豆老师| 久久久不卡国产精品一区二区| 国产精品99无码一区二区| 中文字幕在线人妻| 亚洲国产一区二区三区| 欧美成人高清| 亚洲成人777| 黑人巨粗进入警花疼哭A片| 五月婷婷丁香激情| 四虎影院成人| 三级中文| 精品国产一区二区三区蜜奴| 成人视频网| 超碰人人爱| 四川少妇搡bbw搡bbbb| 男人和女人黄片| 国精产品自偷自偷综合欧美| 亚洲精品V天堂中文字幕| 精品国产免费一区二区三区香蕉| 日韩乱码人妻无码系列中文字幕| 国产精品无码一一区二| 成人免费视频一区二区三区| 精品无码久久久久久久久| 日本高潮视频| 日韩欧美一级| 久久艹综合| 午夜精品一区二区三区文| 国产精视频| 亚洲一区在线不卡| 在线观看欧美黄片| 99精品国产在热久久| 五月综合激情婷婷六月色窝| 亚洲中文字幕在线观看| 另类ts人妖一区二区三区| 色老大影院| 日韩一级| 日韩一区三区| 色婷婷18| 色av综合| 综合天天| 一本色道久久HEZYO无码| 无码人妻精品一区二| 开心五月婷婷| 人人精品| 1234无码| 密桃AV| 国产毛片精品一区二区色欲黄A片| 99精品偷自拍| 疯狂做受XXXX高潮A片| 成人国产欧美大片一区| 大伊香蕉精品视频在线| 色老头xxxx性开放| 舔骚逼视频| 久久国产免费视频| 久久九精品| √天堂资源地址在线官网| 无码人妻丰满熟妇精品| 特级毛片www| 亚洲综合一区二区| 亚欧无码人妻XXXX| 蜜桃视频久久| 一区二区激情| WWW.黄色小说.COM| 欧美a网站| 青青草成人av| 亚洲一区二区三区在线| 国产精品久久久一区二区三区| 年轻的妺妺伦理HD中文| 少妇裸体性生交| 久久久亚洲精品一区二区三区浴池| 亚洲一二区| 亚洲熟女一区二区| 黑人乱码一区二区三区AV| 日韩啪啪视频| av基地网| 亚洲无码一区在线| 亚洲不卡视频| 日韩欧美色| 日韩乱色| 中文字幕永久在线播放| 久久久极品| 成 人片 黄 色 大 片| 成色P31S是国精产品吗| 色呦呦国产精品| 日韩精品久久久久久久| 亚洲AV无码A片在线观看| 青青久久久| 国产夫妻在线视频| 亚洲亚洲人成综合网络| 国产99精品视频| 亚洲视频在线观看网站| 欧美福利一区| 亚洲精品喷潮一区二区三区| 欧美人妻精品一区二区在线| 国产精品无码AV| 性爱国产| 成熟女人毛片WWW免费版在线| 色站综合| 亚洲AvV| 中文字幕无码在线| 任你躁XXXXX麻豆精品| 婷婷综合色| 五月丁香综合网| 欧美高潮喷水视频| 欧美不卡一区| 人与禽A片啪啪| 欧美国产91| 亚洲电影在线观看| 国产精品视频WWW| 欧美www| 国产无码区| 亚洲一区二区三区无码| 国产精品久久久久久久av超碰| 亚洲激情中文字幕| 99在线精品免费视频| 欧美一区二区三区精品| 伊人激情| 免费无码毛片一区二三区| 欧美黄片久久| 日韩欧美第一页| 久久久天堂国产精品女人| 亚洲AV无码国产毛片久久春色| 蜜桃在线视频| 三级视频无码| 国产精品第一国产精品| 日韩AV电影一区二区 | 成人无码精品1区2区3区免费看|